Understanding Investment-Linked Policies: 11 Financial Terms You Should Know Before Investing

This article was written in collaboration with Manulife (Singapore) Pte. Ltd. All views expressed in this article are the independent opinion of DollarsAndSense.sg based on our research. DollarsAndSense.sg is not liable for any financial losses that may arise from any transactions and readers are encouraged to do their own due diligence. You can view our […]

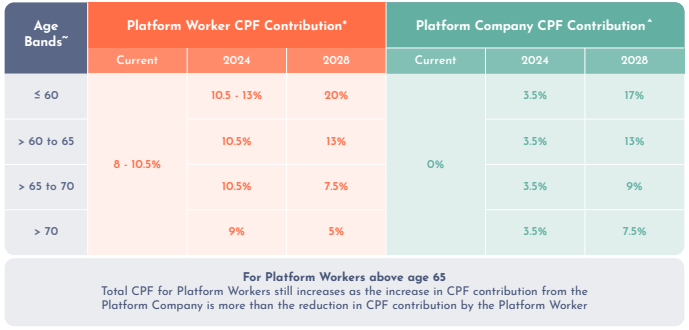

Money No Enough: 7 Financial Expenses (And Rates) That Will Go Up in 2024

By now many of us would have undoubtedly experienced the impact of the rising of living, whether felt from the higher expenses for our everyday necessities or increased admission fees to attractions during our travels, such as the Louvre Museum in Paris or Disney World in Japan. Over the course of the year, both government […]

Insights: Delayed Gratification and the Rewards of Patience

This article was contributed to us by Chua Ee Chien, and was first published on his LinkedIn. Six years ago, I sold a place that I had bought in the U.S. while living there for a couple of reasons: Managing it from Singapore was pretty hard. It had appreciated by 60% in 3 years, and […]

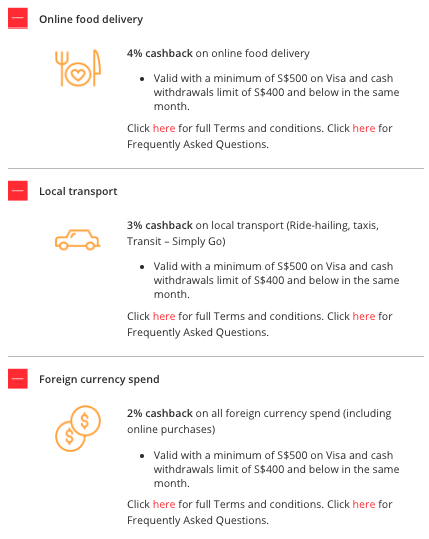

Find It A Hassle To Have A Separate Travel Card Or App? Why DBS Visa Debit Card Is An Easy Solution For Your Foreign Currency Spend

This article was sponsored by DBS. All views expressed in this article are the independent opinion of DollarsAndSense.sg based on our research. DollarsAndSense.sg is not liable for any financial losses that may arise from any transactions and readers are encouraged to do their own due diligence. You can view our full editorial policy here. The pandemic is behind us, […]

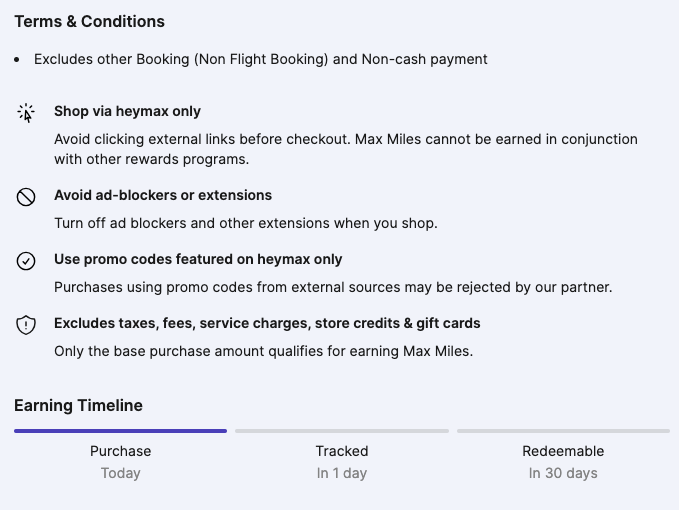

3 Ways To Spend Efficiently When You Travel Overseas & Shop Online

December is traditionally a peak month for businesses in the retail and hospitality sectors, driven largely by the festive season and year-end celebrations. This heightened activity is attributed to increased consumer spending, as people often indulge in purchasing gifts for themselves and their loved ones, as well as in food and beverage (F&B). The allure […]

Why Investing Has Always Been A Marathon, Not A Sprint

This article is sponsored by FSMOne. All views expressed in this article are the independent opinion of DollarsAndSense.sg based on our research. DollarsAndSense.sg is not liable for any financial losses that may arise from any transactions and readers are encouraged to do their own due diligence. You can view our full editorial policy here. For those […]

Tips to Manage Foreign Exchange (FX) effectively for SMEs

This article was written in collaboration with OCBC Business Banking. All views expressed in this article are the independent opinion of DollarsAndSense.sg based on our research. DollarsAndSense.sg is not liable for any financial losses that may arise from any transactions and readers are encouraged to do their own due diligence. You can view our full editorial […]

Are You Better Off Renting While You Wait For Your BTO Flat Or Buy A Resale HDB Immediately

In Singapore, men ready to settle down would subtly propose with the question, “Will you BTO with me?”—the unequivocal term for “Will you marry me?”. However, in recent times, this question has become less straightforward. Long Built-To-Order (BTO) waiting times of between 3 and 4 years and couples marrying later in life have created a […]

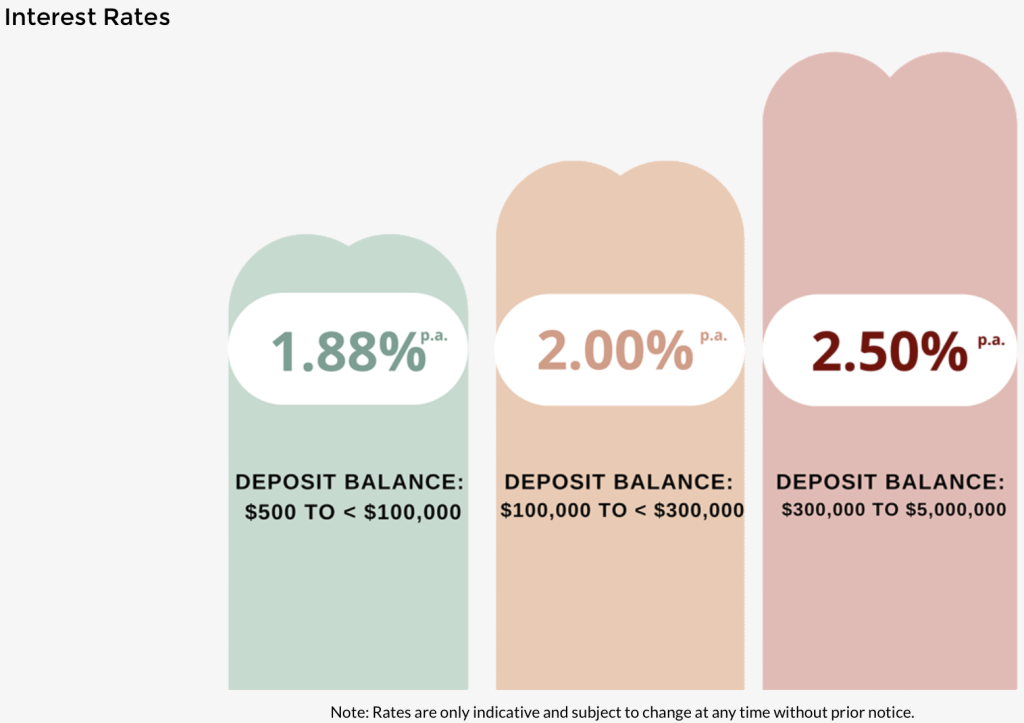

Understanding The Savings Gap: What Do Singaporeans Look For In A Savings Account

This article was written in collaboration with Hong Leong Finance. All views expressed in this article are the independent opinion of DollarsAndSense.sg based on our research. DollarsAndSense.sg is not liable for any investment losses that may arise from any transactions and readers are encouraged to do their own due diligence. You can view our full […]

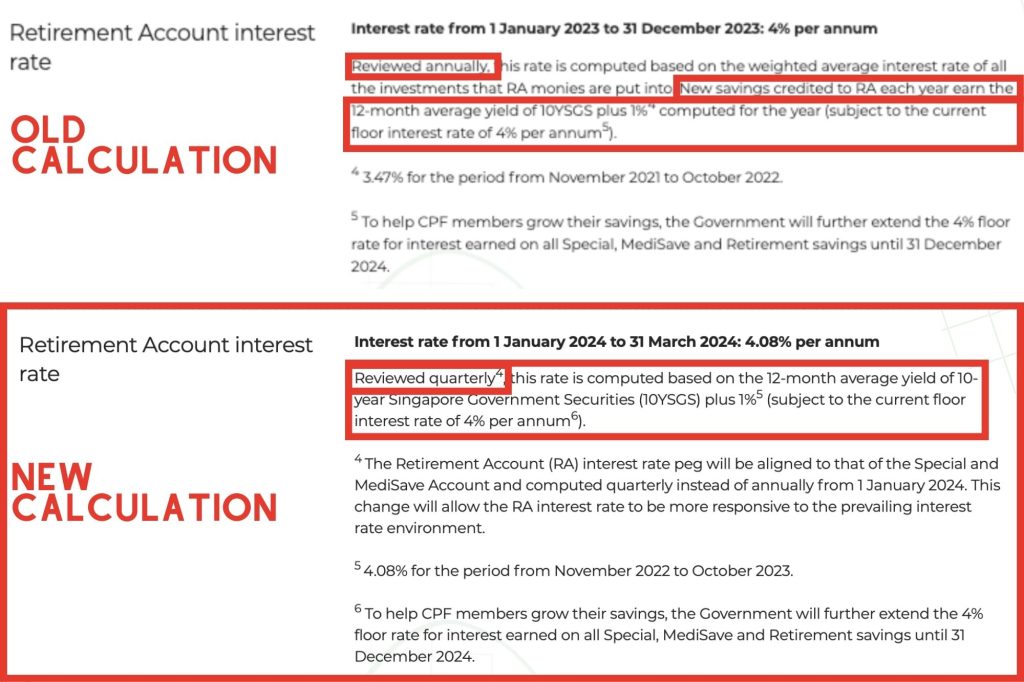

Why CPF Changed The Way Our Retirement Account (RA) Interest Rates Are Calculated

Given the low interest rate environment over the past 20 years, most of us were happy enough to earn the floor interest rates on our CPF accounts. While our CPF Ordinary Account (OA) earns a floor interest rate of 2.5%, our Special Account (SA), MediSave Account (MA) and Retirement Account (RA) earn a higher floor […]