December is traditionally a peak month for businesses in the retail and hospitality sectors, driven largely by the festive season and year-end celebrations.

This heightened activity is attributed to increased consumer spending, as people often indulge in purchasing gifts for themselves and their loved ones, as well as in food and beverage (F&B). The allure of overseas holidays adds to this surge in expenditure.

However, the concept of smart spending extends beyond just seeking out year-end clearance sales or bulk purchase discounts.

Being a savvy consumer involves understanding how to maximize the value of every dollar spent. This means not only looking for good deals but also making informed choices on how we choose to pay for the products and services we purchase.

In this article, we highlight some ways in which online shoppers and overseas travellers can fully optimise their spending just by paying in the right way.

#1 Use heymax To Accumulate Additional Miles

Shop, earn and pay.

If you don’t recognise this tagline, it’s that of ShopBack, a platform that helps people earn cashback when they shop. The cashback that is earned from ShopBack is on top of other discounts, promotions, miles or cashback that you also earn when you spend on your credit cards.

In other words, ShopBack gives you additional cashback on the purchases you make, without taking away any of the promos and perks you also will enjoy when you pay using your credit cards.

For miles lovers, we have some good news for you. There is now an equivalent of ShopBack for folks who are in the miles game – heymax.

If you understand how ShopBack works, it’s fairly easy to grasp how heymax operates.

When you make a purchase via heymax on your favourite airlines, hotels or any merchant that is listed on heymax, you will not only earn the usual miles, cashback or other benefits from the credit cards you use but also Max Miles as well.

Max Miles, which do not expire, can then be transferred to airline and hotel programs starting at a 1;1 transfer ratio with no conversion fee.

For example, if I spend $3,000 on Singapore Airlines, I may get 1.2 KrisFlyer miles per $1 spent from my credit card. So I am already getting 3,600 miles.

On top of that, I can also earn an extra 0.5 Max Miles per 1 SGD spent as well. Based on a $3,000 spend, this means I get 1,500 Max Miles. This can then be converted for KrisFlyer miles or any other airline or hotel loyalty program that Max Miles partners with.

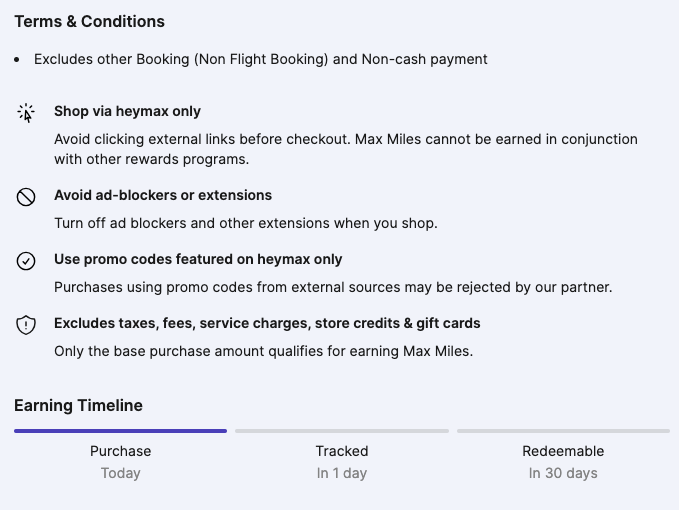

There are terms & conditions that you need to adhere to ensure you are credited with the Max Miles, but this is no different from platforms like ShopBack.

#2 Use Multi-Currency Cards & Wallets When Travelling Overseas

Cash is not king.

A decade ago, the conventional wisdom is that it’s better to pay using cash whenever we travel overseas. This is because we get a better exchange rate when we convert our Singapore Dollar for foreign currencies. Also, we avoid paying foreign exchange administrative fee, which is usually around 2-3% of the transaction amount.

These days, cash is no longer king.

Instead, we should consider using multi-currency cards and wallets such as Revolut and YouTrip to pay for our expenses when we are travelling overseas.

Besides the convenience, the key advantage these cards offer is the competitive exchange rate they offer. Unlike traditional banks and moneychangers, particularly those located at airports or other obscure locations overseas, multi-currency cards can offer much more competitive rates that are similar to the current spot rate. There are also lower or no fees for currency conversion, and this includes savings on various transactions like ATM withdrawals and foreign transaction fees.

With these multi-currency cards and wallets, there is also no need to finish all our foreign currencies before returning home. Instead, they can be easily kept in our multi-currency wallet and we can convert from one foreign currency to another, without having to change it back to Singapore Dollar first and incurring the cost of the spread.

Read our trip review on YouTrip and Revolut.

#3 Get Travel Insurance Without Overspending

Planning a holiday for the entire family is exciting but also stressful, with concerns about potential issues like COVID-19, trip cancellation, lost baggage, or flight disruptions. It’s important to stay cautious abroad as illness, accidents, or crime can occur, making travel insurance essential for financial protection against such events.

Travel insurance is key for peace of mind on overseas trips, but it’s important to balance coverage with cost.

With the goal of making travel insurance more accessible, Seedly has introduced Seedly Travel Insurance, underwritten by HL Assurance. This insurance is affordable, includes COVID-19 coverage, and provides essential benefits, aiming to cost less than standard policies. For example, at just $19.91 for a 3-day trip to Bangkok, this may potentially cost less than your cab ride to the airport.

For parents who are travelling with their children, the good news is that the Seedly Travel Insurance will automatically cover our children at no additional cost. The insurance also covers Child Support Grant and Child Companion Benefit in cases where the insured parent(s) meet a mishap. So not only do we get to pay less for our travel insurance as adults, but our kids also get covered for free.

Read Also: Why It’s Important To Buy Travel Insurance For The Family Even For Short Holidays

Listen to our podcast, where we have in-depth discussions on finance topics that matter to you.