This article was written in collaboration with GovTech. All views expressed in this article are the independent opinion of DollarsAndSense.sg based on our research. DollarsAndSense.sg is not liable for any financial losses that may arise from any transactions and readers are encouraged to do their own due diligence. You can view our full editorial policy here.

According to the Accounting and Corporate Regulatory Authority (ACRA), there are a total of 587,367 registered business entities in Singapore as of October 2023. This also means that there is more than 1 business for every 10 people in Singapore.

New businesses are also starting all the time. On average, in 2023, about five to six thousand businesses are registered each month.

While the majority of business entities in Singapore are known as companies (425,490 out of 587,367 as of October 2023), sole proprietorships and partnerships form the second-largest group of business entities (142,893 out of 587,367 as of October 2023) in Singapore.

Source: ACRA

But what exactly are the differences between companies, sole proprietorships and partnerships? More importantly, which would be the most suitable business structure to choose when you register your business?

The Start-Up Guide on the GoBusiness website gives you a detailed overview of the different types of business structures and also a comprehensive step-by-step guide on starting a business in Singapore. In this article, we dive deeper into the three most common business structures found in Singapore and other valuable insights and information for aspiring entrepreneurs.

Sole Proprietorship

Let’s start with the simplest type of business structure – sole proprietorship.

As its name suggests, a sole proprietorship is a type of business structure where an individual operates and owns the entire business. The key advantages of sole proprietorships are that the business owner has absolute control over the business and faces minimal compliance requirements.

For example, business owners only need to renew their business registration annually. Profits generated by the businesses are attributed to business owners, who pay tax based on their personal income tax rate. There is also no need to hold Annual General Meetings, prepare financial statements or perform mandatory audits.

In a sole proprietorship, both you, the business owner, and your registered business are considered a single legal entity. This also means that you are personally liable for any business debt or legal consequences resulting from business operations.

Partnerships

A partnership is similar to a sole proprietorship with the exception that it’s formed by two or more partners (capped at 20).

There are also Limited Partnerships (LP) and Limited Liability Partnerships (LLP).

A Limited Partnership (LP) involves a partnership with a minimum of two partners, including one general partner and one limited partner. The LP itself does not have a separate legal entity from its partners. A general partner is responsible for the actions of the LP and is liable for all its debts and obligations. In contrast, the limited partner’s liability is restricted to their agreed contribution, as long as they refrain from involvement in the business management.

A Limited Liability Partnership (LLP) is a business structure where two or more partners establish a separate legal entity. Unlike some partnerships, individual partners in an LLP are not personally liable for the actions of their fellow partners. Instead, each partner is personally responsible only for the liabilities arising from their own actions.

Unlike sole proprietorships, an LLP is required to maintain up-to-date books of accounts and declare annually whether it’s solvent or insolvent.

Companies

Unlike sole proprietorships, companies are legal entities that have a separate and distinct identity of their own. A company has the right to own property, has perpetual succession and can sue or be sued in its own name.

Companies are subject to more corporate governance requirements compared to sole proprietorships. These include the need to appoint a qualified company secretary, appoint at least 1 Singapore resident as a company director, and the obligations to file annual returns and minutes of Annual General Meetings. Companies are also required to retain documents of financial transactions for at least the past 5 years.

The most common type of company in Singapore is the private limited company.

One advantage of starting a private limited company is its ability to issue shares, transfer share ownership, and get external investors for the business. Also, unlike sole proprietorships and partnerships, where business owners may face unlimited liabilities, private limited companies have their liabilities limited to the capital invested by their shareholders.

Identify The Right Structure With The GoBusiness E-Adviser For Business Structure

If you are a first-time entrepreneur looking to register your business, it might be confusing to figure out the right business structure to choose.

To make it easier, there is an e-Adviser for Business Structure that can be found on the GoBusiness website. By answering 5 questions that would take 2 minutes to complete, the e-Adviser can recommend a business structure that best fits your business needs.

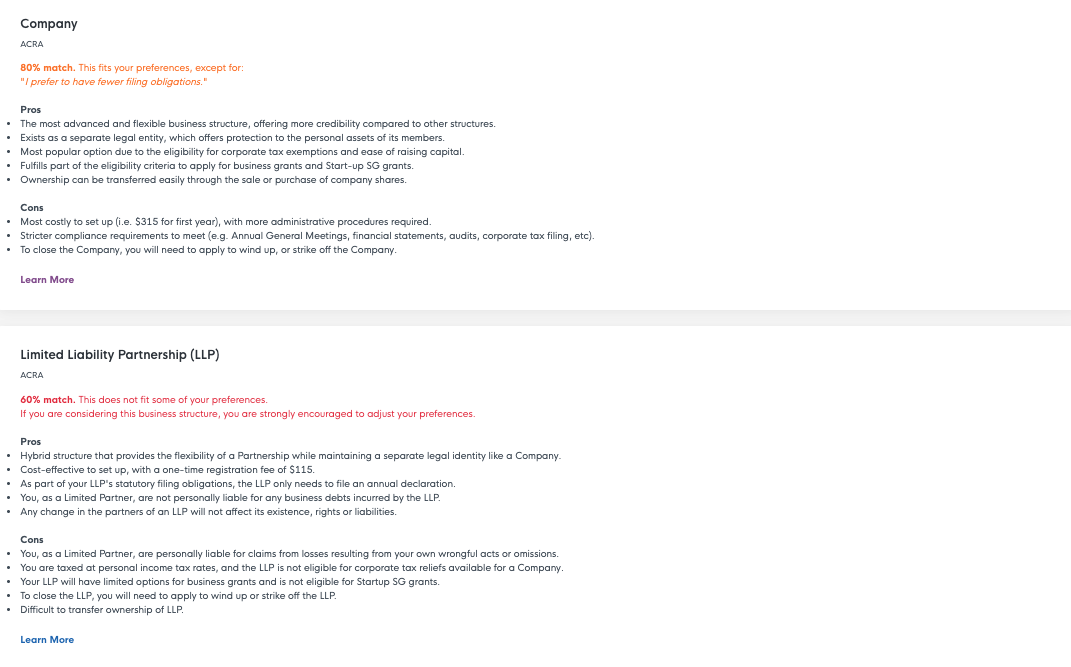

For example, for a risk-averse individual who wants to keep their personal assets separate from the business and hopes to expand their business, yet prefers to have fewer filing obligations if possible, the e-Adviser recommends that registering a company is an 80% match for their preference, while an LLP is a 60% match.

One useful feature of the e-Adviser for Business Structure is its comprehensive approach to recommendations. It doesn’t just suggest one business structure; rather, it tailors its suggestions based on your response to the 5 questions asked. It also provides the pros and cons associated with each business structure, providing users with a clear understanding to make informed decisions.

Beyond just advising on the ideal business structure to register for, there are other valuable tools on the GoBusiness website that can help entrepreneurs. The e-Adviser for Starting a Business, for instance, takes you through a step-by-step journey to registering your business in Singapore.

For businesses looking to register a sole proprietorship or partnership, you can complete the entire registration process on GoBusiness. Additionally, for aspiring entrepreneurs aiming to kickstart a small-scale business from home, there is also an e-Adviser for Home-Based Businesses tailored just for them.

You can watch this video for a step-by-step walkthrough guide on registering a sole proprietorship on GoBusiness.

Once you have set up your company, you may need other support such as additional capital to expand your business. For business owners looking to apply for grants and subsidies, you can do so via the Business Grant Portal (BGP) on the GoBusiness website.

The wealth of resources available on GoBusiness ensures that business owners are equipped not only with the right structure, but also with the necessary guidance and tools for success.

If you are a new business owner or are looking to start your own business, join the GoBusiness mailing list and stay up to date with the latest resources, initiatives and schemes that are introduced to support companies in Singapore.

Read Also: 5 Government Grants & Subsidies To Know When Starting A Business