A solid pillar of Singapore’s healthcare safety net is CareShield Life. When you become seriously disabled and need long-term care, it pays out monthly for the rest of your life. However, like any simple plan, there is still the question: Is it sufficient?

This article examines whether the base coverage offered by CareShield Life is adequate, when it might not be, and how supplement plans can offer superior protection against disability costs, losing your independence, and becoming a financial burden on your loved ones.

A Brief Summary of CareShield Life’s Coverages

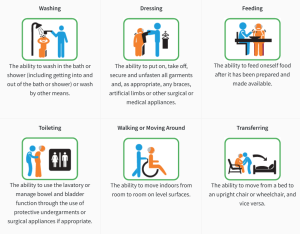

If you become severely disabled, which is defined as being unable to perform at least three of the six Activities of Daily Living (ADLs), CareShield Life will pay you a monthly cash benefit for the rest of your life.

The payout begins at $649 per month in 2025 and rises yearly until a claim is submitted. Given that MediSave can be used to cover the entire cost, that is a good starting point.

The problem is that most Singaporeans’ actual long-term care needs will not be met by $649 per month.

Why CareShield Life Might Not Be Sufficient

One in two Singaporeans over 65 will experience severe disability at some point in their lives, and many of them will need long-term care for ten years or longer, according to the Ministry of Health.

Let’s examine typical expenses:

| Type of Care | Estimated Monthly Cost |

|---|---|

| Home caregiver | $1,200 – $2,000 |

| Nursing home stay | $2,000 – $4,000 |

| Day care services | $800 – $1,500 |

These expenses far outweigh CareShield Life’s monthly payout, even at the lower end.

This disparity in income may compel families to:

- Utilise your retirement funds.

- Depend on the earnings of your children

- Give up the standard of care

Many Singaporeans are using CareShield Life Supplement Plans to prevent these consequences and preserve their financial independence.

CareShield Life Supplement Plans: What Are They?

Supplements are optional add-on plans that improve your CareShield Life coverage and are provided by private insurers.

They offer:

✅ Higher Monthly Payouts

Some plans offer up to $1,200, $2,000, or more per month, depending on your choice of premium.

✅ Lower Disability Threshold

While CareShield Life requires disability in 3 ADLs, supplements may start payouts at just 2 or even 1 ADL, meaning earlier financial support.

✅ Extra Benefits

Some supplement plans include:

- Lump sum payouts upon diagnosis

- Rehabilitation benefits

- Caregiver support

- Waiver of future premiums during disability

What Is the Price of Supplements?

- The following factors affect premiums:

- Entry-level age

- Gender

- Monthly benefit that is desired

- Features that are optional (like inflation protection)

An estimate for a 40-year-old in good health selecting a $1,200/month payout plan is as follows:

Premium: approximately $300 to $600 annually

Due at age 67 or 68

able to utilise MediSave (up to $600 annually per insured)

As with the basic CareShield Life, many people do not need to pay cash.

How to Pick the Ideal Supplement

The following three steps will help you make a decision:

1. Calculate Your Needs for Long-Term Care

Think about your preferences for future care. Would you like home care? Nursing in private? Assisted living? You might spend more than $2,000 a month.

2. Examine Your Spending Plan

Start by using your MediSave. Consider whether you can afford to pay the remaining amount in cash if the supplement you want costs more than the $600 annual MediSave cap.

3. Examine Insurance Companies

Why It Matters: Maintain Your Dignity and Choices

Long-term disability doesn’t just affect your health—it impacts your independence, dignity, and lifestyle choices.

With only the base CareShield Life payout, you may have to:

- Settle for lower-quality care

- Rely heavily on family support

- Delay professional help due to cost

- A supplement empowers you to:

- Choose the best care available

- Protect your family’s finances

- Age with dignity and financial confidence

Conclusion: Top Up for True Protection

CareShield Life is a smart and essential starting point—but for most, it’s just the beginning of proper long-term care planning.

With affordable supplement plans and the flexibility to pay via MediSave, there’s little reason not to upgrade.

After all, protecting your financial freedom during life’s most vulnerable moments may be the most important insurance decision you ever make.

Take action now. If you need help as to where to start, feel free to contact us for a non-obligatory chat.

Read next : “What Happens When You Need Long-Term Care in Singapore? A Financial Walkthrough”?