As Singapore’s population grows and life expectancy rises, long-term care costs become a bigger part of financial planning. But for many Singaporeans, they still don’t think about it until it’s too late. This post will explain:

- what long-term care is,

- why everyone, not just older people, needs to plan for it

- how planning ahead can help you keep your independence and financial freedom.

1. What is long-term care?

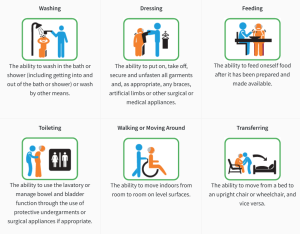

Long-term care includes all the services and help someone needs when they can’t do simple daily tasks like eating, bathing, dressing, going to the toilet, transferring, or moving around on their own.

This need can come from being sick, having a disability, or just getting older.

Contrary to what most people think, long-term care is not just available in nursing homes. It can pay for care given at home, in an assisted living facility, or at a nursery.

How often do people in Singapore need long-term care?

One in two healthy 65-year-olds will become seriously disabled at some point in their lives and need long-term care. Three out of ten of them will be handicapped for ten years or more. (Singapore Ministry of Health)

Shocking? It is more common than we think.

Image from https://www.careshieldlife.gov.sg/careshield-life/careshield-life-claims.html

2. Why planning for long-term care is so important

Long-term care is everyone’s personal duty.

Getting ready for long-term care is an important part of overall financial planning, just like saving for college or retirement. It’s about making life easier for your family, and making sure that life doesn’t catch you off guard.

Review your plan now, no matter what age you are (30s, 40s, or 50s).

The real cost of care are both in terms of money and emotions.

A lot of people don’t realise how much long-term care costs.

Costs can easily go over $2,000 a month, whether the person lives at home or in a facility, depending on how much help they need. These disability costs add up quickly and often go over savings. If you don’t plan ahead, family members may have to take on the financial burden, which can cause stress, hurt relationships, and changes to your retirement plans.

Even so, the effect goes beyond dollars and cents. When someone can’t take care of themselves, they lose their freedom. This can be a very stressful event. It affects both the person and the people who care for them.

3. How planning ahead can help you keep your independence and financial freedom.

If you act quickly, you’ll have more options and save money. Pros of planning for long-term care ahead of time:

- Keep some control over the quality of care you get.

- Don’t put too much financial stress on your loved ones.

- It also fits your goal of financial freedom, which means being able to live your life the way you want to even if you have health problems.

How Does CareShield Life Work?

CareShield Life is a national insurance program that helps Singaporeans pay for long-term care by giving people monthly payments for life if they become severely disabled. Some important features are:

- Starting at $649 a month (as of 2025), payments will be made every month for life.

- Every year, payouts go up to keep up with inflation.

- Lifetime coverage after signing up.

- Premiums are payable by MediSave.

- Required for people born after 1980; not required those born before.

- People with basic financial needs can get CareShield Life, but people who desire more care may choose to add on to it with CareShield Life Supplements from private insurance.

Closing thoughts on financial planning for long-term care

In the end, growing old is not a choice, nor are disabilities that occur due to sickness or accidents.

Life is full of risks and uncertainty; the only thing we can control is how we make our financial plans today so that we can live with assurance tomorrow. Care that lasts a long time is not just a problem for older people.

Don’t wait for a problem to take charge. Take charge of the problem or risks now before it takes charge over you.

Taking action with the right financial plans or CareShield Life can help you not only control the costs of a possible injury but also get closer to being financially free.

Take action now. If you need help as to where to start, feel free to contact us for a non-obligatory chat.

Read next: “The Hidden Costs of Disability: How to Prepare for Unexpected Disability Expenses“