This article was written in collaboration with Citibank Singapore. All views expressed in this article are the independent opinion of DollarsAndSense.sg based on our research. DollarsAndSense.sg is not liable for any financial losses that may arise from any transactions and readers are encouraged to do their own due diligence. You can view our full editorial policy here.

Credit card reward points are incentives offered by credit card companies to encourage spending by cardholders in exchange for reward points. The points earned can be redeemed for various rewards, such as gift vouchers, miles, cash rebates, and others.

How Credit Card Reward Points & Programs Work

For example, Citi has reward credit cards like the Citi Rewards Card and the Citi Prestige Card that allow cardholders to earn Citi ThankYouSM Points. These points can be used to redeem rewards from Citi ThankYouSM Rewards, a reward points program offered by Citi.

On the Citi ThankYouSM Rewards site, points can be redeemed for a range of useful rewards that include gift vouchers and cash rebates. We can also offset purchases or reduce statement balance with our Citi Points/Miles via Pay with Points!

How To Earn Reward Points Efficiently?

Whenever we pay using our reward credit cards, we earn points.

Using the popular Citi Rewards Card as an example, we see that we can earn 1 Point for every $1 spent. However, if we use the card to pay for online purchases (ie., brands like Shopee, Amazon, Lazada or even online grocery, food delivery and ride-hailing) or in-store shopping purchases, we can earn 9 Bonus Points for every S$1 spent. This means if we spend $600 a month on online purchases, we earn 6,000 points. Multiply that by 12 months, and we would have accumulated 72,000 Points within one year. Do take note that Bonus Points are capped at 9,000 Points per statement month.

Thus, it’s a good idea to know which spending categories can earn us Bonus Points and to always ensure that we pay for purchases in these categories using the optimal reward cards to maximise the points we earn.

Also, if you are applying for a Citi Credit Card for the first time, don’t forget to check for welcome offers.

If you have yet to own any Citi Credit Card, apply for a Citi Rewards Card between now until 31 January 2024 and enjoy a welcome bonus of 40,000 Citi ThankYouSM Points when you make a $800 qualifying spend within the first two months of card approval.

How To Redeem Our Points For Rewards?

To optimise for reward programmes, it isn’t enough just to maximise the points we earn on our spending. We also have to be strategic in the way we choose to redeem our rewards.

The first thing to identify is the type of reward we want. Reward programs such as Citi ThankYouSM Rewards provide multiple redemption options such as gift vouchers, cash rebates, points transfer to miles, and even Pay With Points (PWP).

Assuming we have been spending $600 a month on online purchases for 12 months and also qualify for the welcome offer of 40,000 bonus Citi ThankYouSM Points, we would have accumulated 112,000 Points within the year. This would be enough to redeem us 7 X $50 Harvey Norman vouchers (15,950 Points for each $50 voucher), 16 X $20 Takashimaya vouchers (6,720 Points for each $20 voucher) and many other gift vouchers with our favourite retail shops.

We can now redeem more vouchers with categories ranging from dining, home and living, shopping and petrol!

Screenshot of selected vouchers redemption catalogue

If we redeem our points for the vouchers during a promotion, we can get an even better redemption return. For example, Citi is currently running a promotion where we can get up to 25% off for selected vouchers. This means that with the same number of points, we can now redeem more vouchers.

If we want to convert our Points for miles to redeem a flight, we can also do so at a ratio of 25,000 Points for 10,000 frequent flyer miles. This means 112,000 Points will give us the equivalent of 44,800 frequent flyer miles. Do note that when we convert our Points to frequent flyer miles, we would still need to ensure that we are able to redeem the frequent flyer miles for the flights that we want and that these frequent flyer miles may also expire, or be subject to devaluation in the future.

Points can also be used to redeem for cash rebates on our credit card statements. This is at a block of $10 for every 4,440 Points. However, the limitation here is that you need a minimum of 4,440 Points to make a $10 redemption.

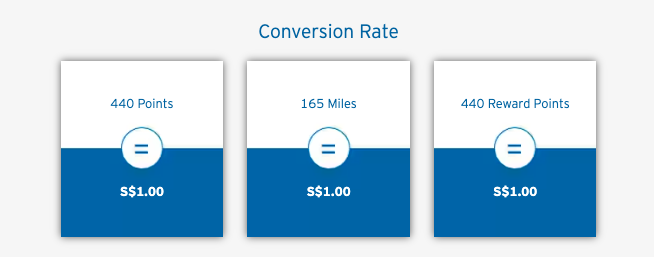

Alternatively, we can also choose to Pay With Points (PWP) at the conversion rate of 440 points to $1.

One thing that you will realise on the Citi ThankYouSM Rewards site is that even if you are someone who is using the Citi PremierMiles Card, you can also convert your miles into cashback, gift vouchers or Pay With Miles (PWM).

Redeem Your Rewards Sooner, Rather Than Later

While it could be tempting to accumulate points, one mistake to avoid is saving up points for too long without using them. After all, points are meant to be used, and similar to our fiat currency, they may suffer from inflation as well.

For example, if we are keen to buy a product that costs us $100 today, we can pay using 44,000 Points (440 Points for $1). However, if the same product were to cost $110 a year later due to inflation, then it would cost us 48,400 Points in the future.

Even if we were to redeem our points for frequent flyer miles, it can still be devalued. For example, airlines may update their redemption chart and require more frequent flyer miles to redeem for the same flight in the future.

One way to strategically redeem our points would be to look out for promo offers. Similar to how airlines sometimes offer a discount for flight redemption, credit card companies may also offer discounts for point redemptions.

Enjoy Up To 25% Off Pay With Points & On Selected Vouchers Redemption

For a limited time only till 29 February 2024, Citi Cardmembers can enjoy up to 25% off Pay with Points and selected vouchers redemption via the Citi Mobile® . This would be an opportune time to redeem your Points for the selected vouchers you want, or to consider paying for your credit card spending with Points. With the festive season nearing, it’s also an ideal way to use your Points efficiently to offset your spending.

If you are keen to get started on a rewards credit card, Citi offers a few rewards credit cards that you can consider applying for. These include the Citi Rewards Card and the Citi Prestige Card.

For existing users, it’s worth remembering that accumulating reward points is only one-half of the equation. For us to fully enjoy the rewards points we have earned, it’s just as important that we redeem the points for the rewards we want at the best possible conversion rate.