By now many of us would have undoubtedly experienced the impact of the rising of living, whether felt from the higher expenses for our everyday necessities or increased admission fees to attractions during our travels, such as the Louvre Museum in Paris or Disney World in Japan.

Over the course of the year, both government and private bodies have made announcements regarding rate adjustments, either already implemented this year or set for the upcoming year, 2024.

Here’s a summary of the key rate increases that will affect us in 2024.

#1 Goods And Services Tax (GST) Set To Increase To 9% From 1 January 2024

One of the expenses that affects all of us when buying goods or services in Singapore is the Goods and Services Tax (GST). It was first introduced on 1 April 1994 at a rate of 3% and is levied on all goods and services supplied by GST-registered persons, including imports into Singapore.

Since 1 July 2007 the GST rate has remained unchanged until announcements were made in Budget 2022 to raise it to 9% by 2024. The rate change was initially initiated with a preliminary 1% increment to 8% from 1 January 2023 as part of the two-step GST rate change. The subsequent rate hike of another 1% will take effect on 1 January 2024 raising the GST rate to 9%.

Read Also: GST Voucher (GSTV) Scheme: How This Permanent Scheme Supports Singaporeans As GST Rates Increases

#2 Higher Additional Buyer Stamp Duty Rate And Property Taxes In 2024

As a nation that boasts one of the highest home ownership rates, it is undeniable that property holds a coveted status as an asset class. However, the dream of owning multiple properties may have hit a snag with the latest property cooling measure announced on 27 April 2023. The revised rates are as follows:

First Residential Property

Second Residential Property

Third & Subsequent Residential Property

Singapore Citizens

Nil

20%

(Previously 17%)

30%

(Previously 25%)

Singapore Permanent Residents

5%

(Unchanged)

30%

(Previously 25%)

35%

(Previously 30%)

Foreigners

60%

(Previously 30%)

Furthermore, with the recent steep rise in home values, the annual values of HDBs and most private residential properties will be raised from 1 January 2024.

Similarly, as announced in Budget 2022, the second and final step of the property taxes (PT) rate for most residential properties will also be raised with effect from 1 January 2024 to reflect the rise in market rents and annual values.

Annual Value

Property Tax Rate for Owner-Occupied Residential Properties

Effective 1 Jan 2023

Effective 1 Jan 2024

First $8,000

0%

0%

Next $22,000

4%

4%

Next $10,000

5%

6%

Next $15,000

7%

10%

Next $15,000

10%

14%

Next $15,000

14%

20%

Next $15,000

18%

26%

Above $100,000

23%

32%

Annual Value

Property Tax Rate for Non-Owner-Occupied Residential Properties

Effective 1 Jan 2023

Effective 1 Jan 2023

First $30,000

11%

12%

Next $15,000

16%

20%

Next $15,000

21%

28%

Above $60,000

27%

36%

It’s worth noting that the PT rate increase will only affect non-owner-occupied residential properties and owner-occupied residential properties with an annual value of more than $30,000. Effectively, if you reside in your own HDB flat, there is no PT rate change.

Read Also: Complete Guide To Property Tax For Homeowners In Singapore

#3 Standard Regular Mail Will Increase To 52 Cents Up From The Current 31 Cents

With most of our communication moving to electronic modes such as emails and instant messaging services, it’s unsurprising that demand for traditional postal services has declined. Consequently, the national postal service provider, Singapore Post Limited (SingPost), raised the rates on its standard regular mail by 20 cents, from 31 cents to 51 cents, effective from 9 October 2023. It further cited escalating the cost of maintaining the postal service for this significant change, which was last carried out in 2014.

Additionally, to reflect the higher GST rate from 1 January 2024, SingPost will also revise the rates for the following services:

Standard Regular Mail: $0.52 (previously $0.51 – increase of $0.01)

Registered Service (Singapore): $6.16 plus prevailing postage rate (previously $6.10 – increase of $0.06)

International Airmail Letters, Printed Papers, Aerogrammes and Postcards: Will increase by $0.05 for Zones 1, 2, and 3.

#4 Adult Public Transport Card Fares To Increase By 10-11 Cents

Renowned globally for its efficiency and effectiveness, Singapore’s public transport system ensures convenient and affordable travel around the city-state for commuters, with the fares reviewed annually.

Based on the latest 2023 Fare Review Exercise (FRE), the Public Transport Council (PTC) granted an overall fare increase of 7% instead of the allowable fare adjustment quantum of 22.6% in 2023. This translates to the following fare adjustments, effective from 23 December 2023:

Fare Types

Category of Public Transport Users

Fare Adjustment for FRE 2023

Card Fares

Adults

10 – 11 cents

(10 cents for journey≤

4.2km; 11 cents for journey

>

4.2km)

Students

4 – 5 cents

(4 cents for journey≤

4.2km; 5 cents for journey

>

4.2km)

Seniors

Persons with Disabilities (PwD)

Workfare Transport Concession

Cash Fares

Adults

20 cents

Students

10 cents

Seniors

PwD

Adult Monthly Travel Pass

No Change

Bus/Train Monthly Concession Passes

No Change

Hybrid Monthly Concession Passes

Up to 10% off current Pass Prices

($4.50 – $9.50 lower)

[New] Workfare Transport Hybrid Monthly Concession Pass

$96

($32 less than the price of Adult Monthly Travel Pass)

Source: PTC

Read Also: Public Transport Voucher (PTV): Who Is Eligible And How Can You Claim It?

Aside from public buses and trains, fares for regular taxis and private-hire cars were also revised higher in the year. Initially, ride-hailing firm Grab raised its platform fee for each ride from $0.30 to $0.70 from 5 May 2023.

Recently, ComfortDelGro, Singapore’s largest regular taxi operator by fleet size, announced changes to its flag-down fares as well as distance and time-based charges. The following rate changes will take effect from 6am, 13 December 2023:

All ComfortDelGro fleet of taxis except limousine taxis will see a fare increase of $0.50 in flag-down fares and $0.01 increase for distances and waiting time fares.

Source: ComfortDelGro

The flag down fare for limousine taxis will remain unchanged as of the last revision in 30 November 2023, though distances and waiting time fares will be increased by $0.01.

The evening peak hour surcharge for all taxis will be extended by one hour from 5pm to 11.59pm. Additionally, a new peak hour surcharge will also be implemented from 10am to 1.59pm on Saturdays, Sundays, and public holidays.

Read Also: Complete Guide To Singapore Taxi Flag Down Rates And Fares

#5 CPF Rate Changes For 2024

The Central Provident Fund (CPF) scheme, introduced in July 1955, helps workers save for retirement by contributing their monthly income. To help workers save more for their retirement needs amidst the rising cost of living, the following changes were announced in 2023:

Increase In CPF Monthly Salary Ceiling To $6,800 From 1 January 2024

The CPF monthly salary ceiling will be raised from the current $6,000 in 2023 to $8,000 in four gradual steps, while the CPF annual salary ceiling of $102,000 remains unchanged. After the first round of adjustment in September 2023, the second round of increases will take effect from 1 January 2024 when the CPF monthly salary ceiling will be raised by $500 from the current $6,300 to $6,800.

Source: CPF

Increased CPF Contribution Rates for Senior Workers Aged 55-70

To help senior workers save more for their retirement needs to cope with the rising cost of living, the CPF contribution rates will be raised for the third consecutive year, from 1 January 2024. The higher contribution rates of between 1% and 1.5% for senior workers aged 55 to 70 will be channelled into their CPF Special Account.

Increase In Minimum CPF Monthly Payout By $100 For Non-CPF LIFE Members From June 2023

Non-CPF LIFE members (i.e., those enrolled in the Retirement Sum Scheme) will receive higher monthly payouts of $350 from June 2023. This is an increase of $100 from the current payout of $250.

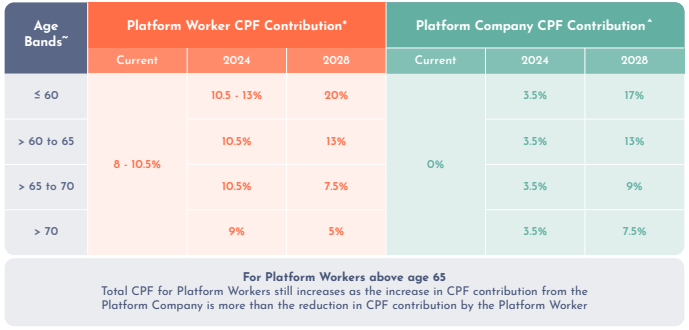

Platform Workers Below Age 30 Will Be Required To Make CPF Contributions From 2H2024

Platform workers such as delivery workers and private-hire drivers below the age of 30 will be required to make CPF contributions from 2H2024. The indicative contributions are as follows:

Source: MOM

Platform workers who earn $500 or less in a month do not need to make the CPF contribution, while the scheme is open on a voluntary basis to those over 30.

Special, MediSave, and Retirement Account (SMRA) Interest Rate Will Rise To 4.08% P.A. From 1 January To 31 March 2024

It’s no secret that interest rates have been rising in 2023. Based on the latest quarterly review, interest rates on Special and MediSave Account (SMA) will be raised to 4.08% p.a. from 1 January to 31 March 2024. This comes as a result of the increase in the 12-month average yield of the 10-year Singapore Government Securities (10YSGS), which the SMA is pegged to.

Additionally, the Retirement Account (RA) will also be pegged to the SMA and compound quarterly instead of annually from 1 January 2024. The RA will follow the same interest rate of 4.08% until 31 March 2024.

Read Also: Why CPF Changed The Way Our Retirement Account (RA) Interest Rates Are Calculated

Basic Healthcare Sum Will Be Raised To $71,500

The Basic Healthcare Sum (BHS) is set to see an increase of $3,000 raising it to $71,500 from the current limit of $68,500 for members below 65 years old, effective 1 January 2024. Conversely, for members aged 66 and above, cohort BHS remains fixed and unchanged.

Members have the flexibility to top up their MediSave Account (MA) up to the BHS, and any surplus contributions would flow to their other CPF accounts.

#6 Higher Utilities Expenses

As the cost of residential homes continues to rise, so does the day-to-day expense of living in them. Several utility-related costs are slated for an increase in 2024.

Service & Conservancy Charges (S&CC) Under PAP Town Councils Will Be Raised Again In July 2024

The Service & Conservancy Charges (S&CC) for HDB residents, shops, offices, markets, and food stalls under all 15 PAP town councils will see an increase in their monthly rates over the next two years. The initial increase came into effect on 1 July 2023, with monthly fees for HDB flats increasing by between $0.70 and $7.90.

Subsequently, the next increment, ranging between $1 and $9.10 for HDB residents, will take effect on 1 July 2024.

Read Also: How Much Service & Conservancy Charges (S&CC) Do You Pay Each Month (And Rebates You Receive)?

Water Price To Increase From April 2024

To reflect the rising costs of producing and supplying water, the Ministry of Sustainability and the Environment announced that the water price will be revised in two phases on 1 April 2024 and 1 April 2025.

The current price of portable water, which is set at $2.74 per cubic metre, will be raised by 20 cents per cubic metre from on 1 April 2024 and by 30 cents per cubic metre from 1 April 2025.

Higher Electricity Prices For Households As Carbon Taxes Increase In 2024

Electricity prices for households may increase in 2024 as power generation companies will face a higher carbon tax on their carbon emissions. From the current $5 per tonne, it will be raised to $25 per tonne in 2024, and to $45 per tonne in 2026 to eventually between $50 and $80 per tonne of emissions by 2030.

If this cost is fully passed on to consumers in 2024, it would translate to an increase of $4 in monthly household utility bills for an average four-room HDB flat, according to an estimate by the National Climate Change Secretariat (NCCS).

Read Also: Complete Guide To Choosing The Best Open Electricity Market (OEM) Plan For Your Home

#7 Higher Bank Charges In 2024

Given the rising interest rate environment that we are currently in, many of us would have noticed a change in our savings and home loan rates. Aside from the published rates, banks in Singapore have also revised their charges to reflect the higher interest rates.

Fees Impose For Cheque Issuing Customers

At least seven banks – DBS, UOB, OCBC, Citibank, HSBC, Maybank and Standard Chartered – announced that they will be charging customers (both corporate and individuals) who issue Singapore Dollar-Denominated Cheques From 1 November 2023. While the other banks will follow suit by 1 July 2024.

Higher Interest Rates On Outstanding Credit Card Balances

Additionally, some local and foreign banks, including HSBC, have announced changes to the interest rate charges and fees that apply to credit card bills in 2023. With interest rate charges above 25% on outstanding credit card payments, it warrants a closer look at how much your bank will charge you in 2024.

Read Also: Banks Will Stop Issuing Corporate Cheques By 2025: 4 Things Businesses Need To Know

Listen to our podcast, where we have in-depth discussions on finance topics that matter to you.