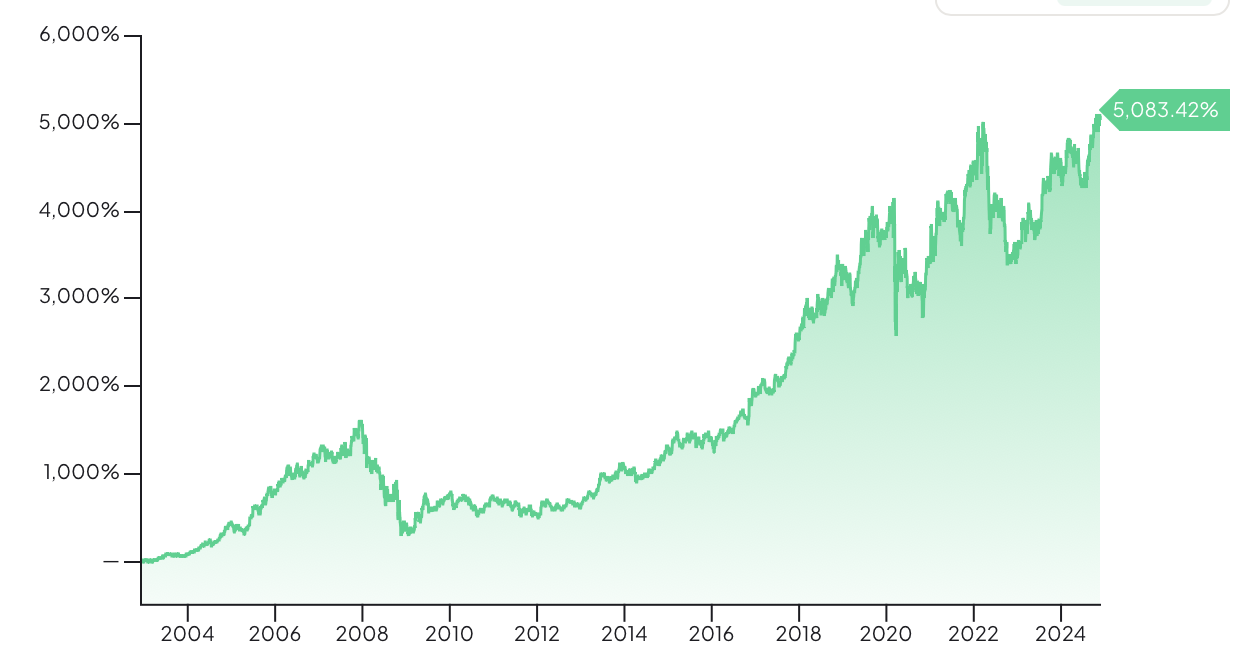

We launched the Compounding Dividends Portfolio 2 weeks ago.

Today we are announcing the second stock we’ll buy

Let’s walk our investment journeys together and build a great portfolio!

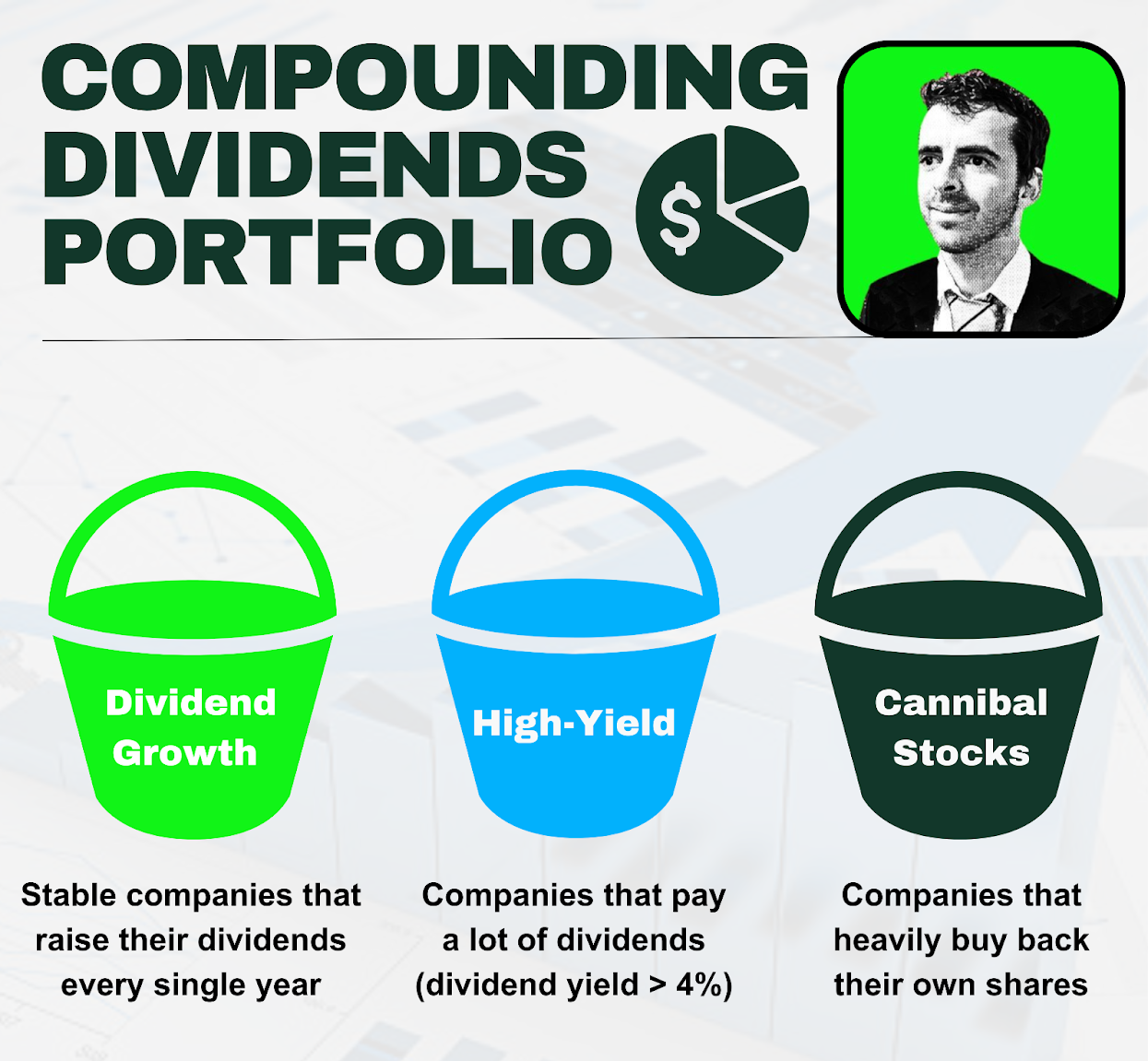

Portfolio Rules

Good agreements make good friends.

Because we are Partners, I will treat you just the same way I would like to be treated.

“We have an attitude of partnership. Charlie Munger and I think of our shareholders as Owner-Operators.” – Warren Buffett

Here are the Portfolio Rules:

-

You can follow the Portfolio 24/7 with 100% transparency

-

REAL money is invested in the Portfolio (skin in the game)

-

The portfolio will be based on a (fictional) amount of $1 million

-

For each company and transaction, you’ll see what percentage we’re investing

-

This way, you’ll understand our confidence in every company and transaction

-

-

No front-running

-

Compounding Dividends will never buy a stock before you have the chance to do so (after doing your own research—please read the disclaimer

-

We’ll announce new transactions during the weekend, and they will be executed the next trading day (on Monday)

-

Our Next Stock

Our next stock is another Dividend Growth Stock, but this one comes with a twist:

It’s already yielding over 4%.

This means it qualifies as a high-yield stock.

-

The company has a very established brand – it’s been operating since 1898

-

It also has a very strong moat created by size, network effects, and cost advantages

-

It generates lots of cash and returns a lot of it to shareholders

-

The company looks attractively valued:

-

It’s trading above its historic dividend yield

-

The Earnings Growth Model says we can expect a 14% return per year

-

The Reverse Dividend Model says it needs to grow the dividend at half its 5-year average rate for a 10% return.

-

Let’s dive into the full Investment Case and prepare our transaction for Monday.

We launched the Compounding Dividends Portfolio 2 weeks ago.

Today we are announcing the second stock we’ll buy

Let’s walk our investment journeys together and build a great portfolio!

Portfolio Rules

Good agreements make good friends.

Because we are Partners, I will treat you just the same way I would like to be treated.

“We have an attitude of partnership. Charlie Munger and I think of our shareholders as Owner-Operators.” – Warren Buffett

Here are the Portfolio Rules:

-

You can follow the Portfolio 24/7 with 100% transparency

-

REAL money is invested in the Portfolio (skin in the game)

-

The portfolio will be based on a (fictional) amount of $1 million

-

For each company and transaction, you’ll see what percentage we’re investing

-

This way, you’ll understand our confidence in every company and transaction

-

-

No front-running

-

Compounding Dividends will never buy a stock before you have the chance to do so (after doing your own research—please read the disclaimer

-

We’ll announce new transactions during the weekend, and they will be executed the next trading day (on Monday)

-

Our Next Stock

Our next stock is another Dividend Growth Stock, but this one comes with a twist:

It’s already yielding over 4%.

This means it qualifies as a high-yield stock.

-

The company has a very established brand – it’s been operating since 1898

-

It also has a very strong moat created by size, network effects, and cost advantages

-

It generates lots of cash and returns a lot of it to shareholders

-

The company looks attractively valued:

-

It’s trading above its historic dividend yield

-

The Earnings Growth Model says we can expect a 14% return per year

-

The Reverse Dividend Model says it needs to grow the dividend at half its 5-year average rate for a 10% return.

-

Let’s dive into the full Investment Case and prepare our transaction for Monday.

We launched the Compounding Dividends Portfolio 2 weeks ago. Today we’re adding another Dividend Growth Stock. This one yields over 4% and is expected to grow well into the future.