Welcome to a new article in Compounding Dividends.

In case you missed it:

- My Dividend Investing Philosophy

- Buying Our First Stock

- All Dividend Aristocrats + 5 of Our Favorites

To make sure you don't miss out, you can subscribe here.Today is Dividend Day.

In this series, I will teach you 5 things about Dividend Investing in less than 5 minutes.

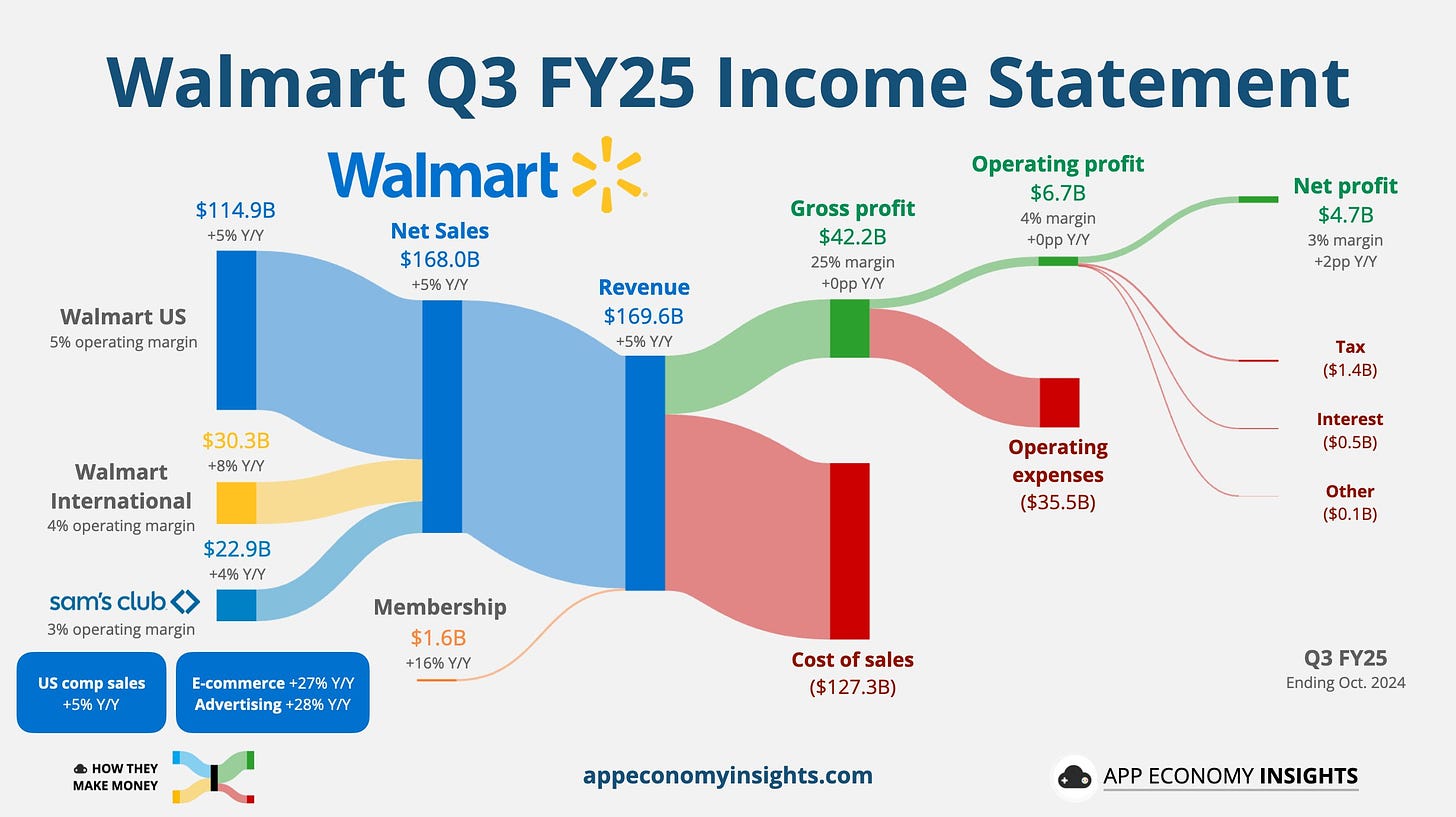

1️⃣ Small Margins, Big Profits

Walmart is a dividend king, with 51 years of dividend raises.

This quarter, they made $4.7 billion (!) in net profits, more than Pfizer, Toyota, or Coca-Cola did last quarter.

The surprising thing?

Walmart only has a 3% net profit margin.

That’s because it operates on a high-volume, low-price model.

They still make a lot of money because their huge scale generates so much revenue.

2️⃣ How To Analyze Dividend Stocks

This image gives a nice overview of metrics used to analyze dividend stocks.

Some of the most important ones?

-

Payout ratio – make sure it’s not too high

-

Dividend growth rate – look for attractive growth

-

Operating cash flow growth – more cash generation allows more dividend growth

3️⃣ An investing quote

Arnold Van Den Berg founded Century Management in 1974 and has consistently beaten all the major market indices.

He is a value investor and considers himself a student of Benjamin Graham.

Both stocks and bonds can provide income, but stocks also have the potential to grow in value over time.

“When stocks yield as much as bonds, you get the growth free.” – Arnold Van Den Berg

4️⃣ Dividend Basics

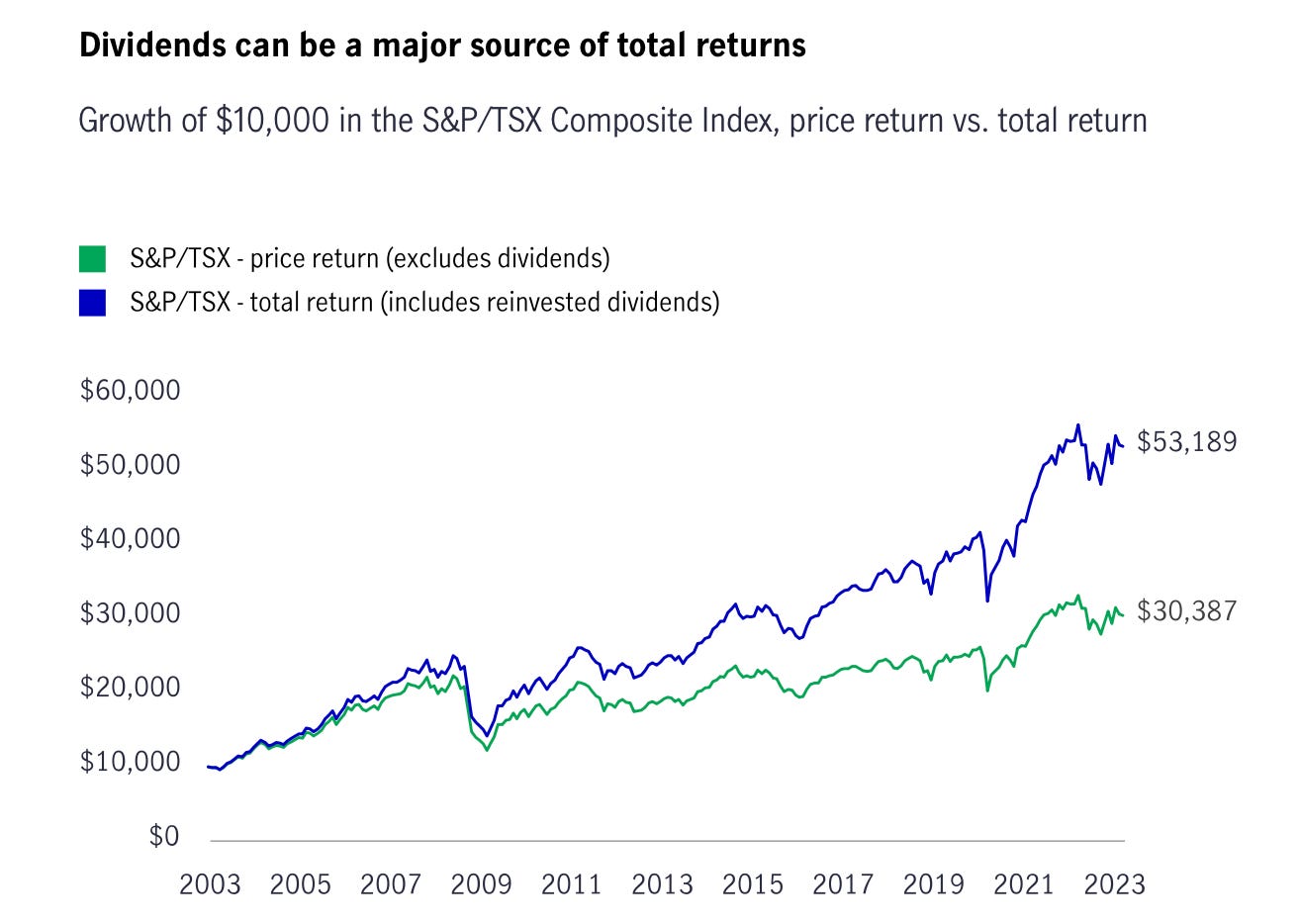

Manulife Investment Management published a great article titled “What are dividends and how do they fit into an investment portfolio?”

It explains what dividends are, why dividend-paying stocks can be good investments, and how compounding your dividends can help grow your money.

Click the picture to read the full article.

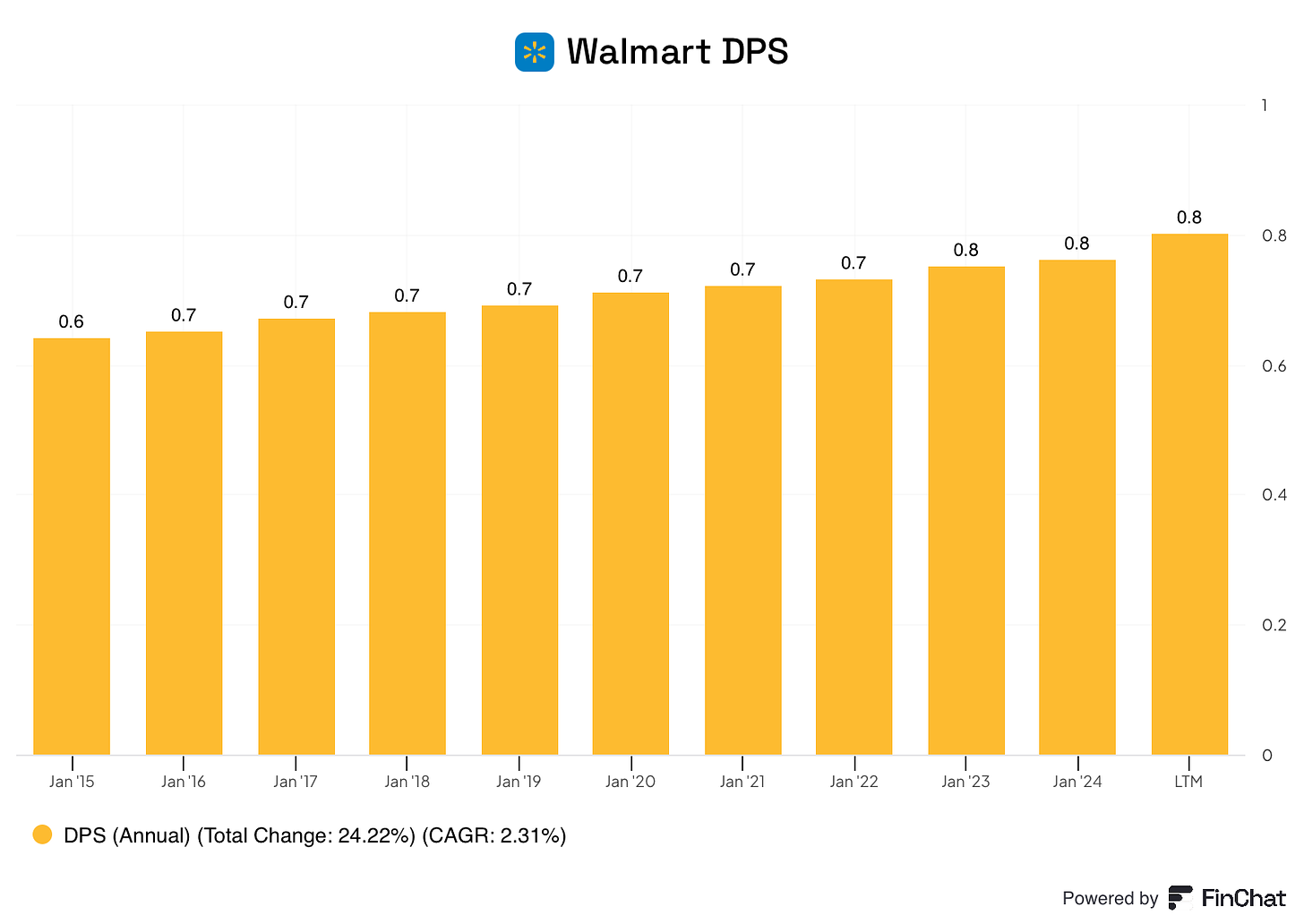

5️⃣ Example of a dividend stock

We started this article with Walmart, and now we’ll end with it.

Walmart makes money by selling a wide range of products at low prices to customers in its stores and online.

Let’s take a look at some of Walmart’s data

-

Profit Margin: 2.4%

-

Forward PE: 31.8x

-

Dividend Yield: 1.1%

-

Payout Ratio: 41.2%

Source: Finchat

That’s it for today

In case you missed it:

Used sources

-

Interactive Brokers: Portfolio data and executing all transactions

-

Finchat: Financial data

Disclaimer

As a reader of Compounding Dividends, you agree with our disclaimer. You can read the full disclaimer here.

Welcome to a new article in Compounding Dividends.

In case you missed it:

- My Dividend Investing Philosophy

- Buying Our First Stock

- All Dividend Aristocrats + 5 of Our Favorites

To make sure you don't miss out, you can subscribe here.Today is Dividend Day.

In this series, I will teach you 5 things about Dividend Investing in less than 5 minutes.

1️⃣ Small Margins, Big Profits

Walmart is a dividend king, with 51 years of dividend raises.

This quarter, they made $4.7 billion (!) in net profits, more than Pfizer, Toyota, or Coca-Cola did last quarter.

The surprising thing?

Walmart only has a 3% net profit margin.

That’s because it operates on a high-volume, low-price model.

They still make a lot of money because their huge scale generates so much revenue.

2️⃣ How To Analyze Dividend Stocks

This image gives a nice overview of metrics used to analyze dividend stocks.

Some of the most important ones?

-

Payout ratio – make sure it’s not too high

-

Dividend growth rate – look for attractive growth

-

Operating cash flow growth – more cash generation allows more dividend growth

3️⃣ An investing quote

Arnold Van Den Berg founded Century Management in 1974 and has consistently beaten all the major market indices.

He is a value investor and considers himself a student of Benjamin Graham.

Both stocks and bonds can provide income, but stocks also have the potential to grow in value over time.

“When stocks yield as much as bonds, you get the growth free.” – Arnold Van Den Berg

4️⃣ Dividend Basics

Manulife Investment Management published a great article titled “What are dividends and how do they fit into an investment portfolio?”

It explains what dividends are, why dividend-paying stocks can be good investments, and how compounding your dividends can help grow your money.

Click the picture to read the full article.

5️⃣ Example of a dividend stock

We started this article with Walmart, and now we’ll end with it.

Walmart makes money by selling a wide range of products at low prices to customers in its stores and online.

Let’s take a look at some of Walmart’s data

-

Profit Margin: 2.4%

-

Forward PE: 31.8x

-

Dividend Yield: 1.1%

-

Payout Ratio: 41.2%

Source: Finchat

That’s it for today

In case you missed it:

Used sources

-

Interactive Brokers: Portfolio data and executing all transactions

-

Finchat: Financial data

Disclaimer

As a reader of Compounding Dividends, you agree with our disclaimer. You can read the full disclaimer here.

In this article we will teach you how to analyze dividend stock, we talk about Walmart ($WMT) and our general dividend investing philospohy.