Why Investing Is Not Optional — It’s Survival Planning

If you’re in your 40s, you’re probably focused on everyone but yourself.

Your kids’ tuition.

Your parents’ medical needs.

Your monthly mortgage and rising bills.

By the time you think about investing, you tell yourself:

“Let me just get through this year.”

But every year feels the same — and suddenly, you’re 55.

The truth is: Waiting to invest is more dangerous than investing itself.

Retirement is not just a number — it’s a reality check.

At age 55, your :

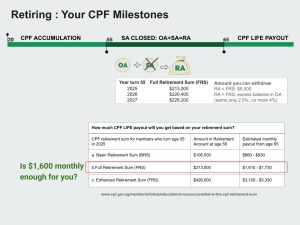

- CPF Ordinary Account (OA) plus your Special Account (SA) balance need to reach the stipulated Full Retirement Sum (FRS).

- SA will be closed and you will get a Retirement Account (RA) to house your FRS.

- Whatever is in excess of the FRS will remain in your OA. You can choose to withdraw that or leave them in your account to earn interest.The CPF Full Retirement Sum (FRS) for those turning 55 in 2025 is $213,000.

That’s the amount you’ll need in your CPF to receive about $1,600 to $1,730 per month for CPF LIFE.

Questions that you need to think about now are:

1.Will your OA + SA get you to the FRS needed by age 55? Otherwise, you won’t be able to withdraw money out of your OA ( except for $5,000)

2. Even if your OA + SA managed to hit FRS, will your monthly payout from CPF Life when you reach 65, be enough for your retirement lifestyle?

So what happens if you don’t start now?

-

You may not qualify for CPF LIFE payouts above the Basic tier

-

You might have to depend on your kids or downsize drastically

-

You’ll lose the advantage of compound interest — time is your ally only if you act early

Investing now is not about being aggressive. It’s about being deliberate.

It doesn’t mean throwing all your money into volatile stocks or crypto.

It means:

-

Using your CPF OA above $20,000 to earn more than 2.5%

-

Leaving your SA to grow safely at 4% or investing if you have balance exceeding $40,000 into a stable investment.

-

Looking at low-risk, stable CPFIS options to supplement your retirement funds

Even small steps can build a better future when you give your money time to grow.

Bottom line?

Investment isn’t just for the wealthy — it’s how everyday people protect their future.

You don’t need to be rich. You just need to be willing to start.

In Part 4, we’ll show you how to invest your CPF safely, even if you’re risk-averse.

Sources:

- https://www.cpf.gov.sg/service/article/how-much-cpf-payouts-can-i-get-every-month

- www.cpf.gov.sg/member/infohub/educational-resources/what-is-the-cpf-retirement-sum

Remember:

- Investing isn’t about taking wild bets. It’s about making smart decisions early.

Next Step: Let’s Talk — No Pressure

You’ve made it this far because you care about your future.

So let’s take the next step — together.

Book your free Savings and Retirement Review session with us

Book your free Savings and Retirement Review session with us