Filing income tax in Singapore

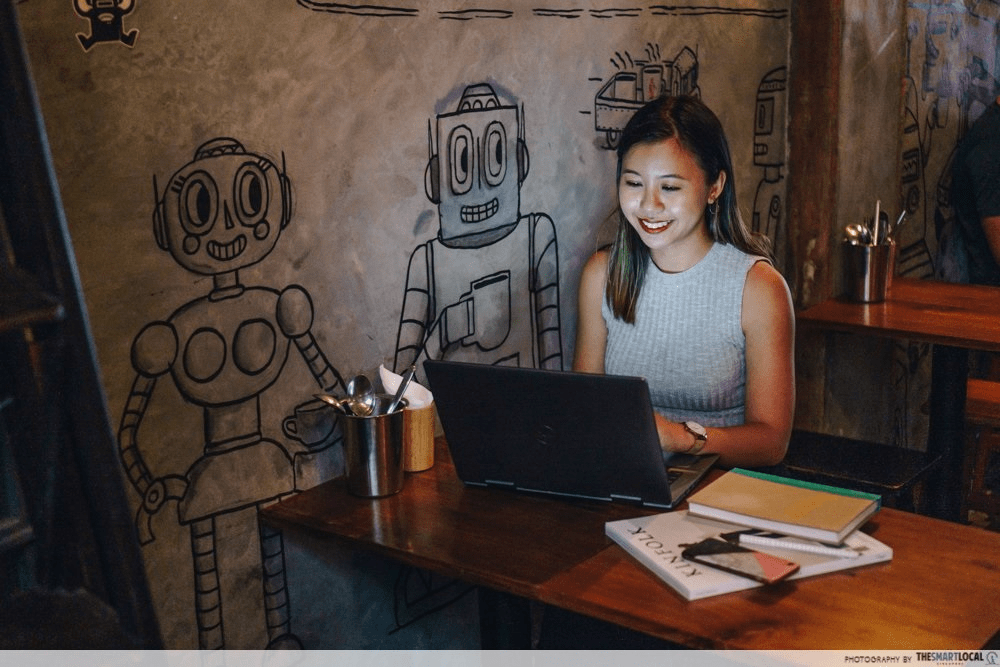

Getting your first job? Check. Getting your first paycheque? Check. Achieving all these firsts can be exciting but adulting becomes very real when you have to start paying your dues. Apart from footing bills, working adults have one more important annual payment – income tax returns.

It might sound daunting but it’s a pretty straightforward process for most. To make things easier, here’s a step-by-step guide on how to file your income tax in Singapore. Btw, you’ll be filing this for income earned in the preceding calendar year from 1st January to 31st December.

Table of Contents

- Filing income tax in Singapore

- Who needs to file income taxes in Singapore?

- What are the income tax rates in Singapore for 2024?

- – How do I file my income tax return? –

- Step 1: Wait for a message from IRAS in early March

- Step 2: Log in to myTax Portal & fill out personal details

- Step 3: Fill out income earned

- Step 4: Make payment

- – All your tax FAQs answered –

- What happens if you don’t file income tax or forget to?

- What is not taxable in Singapore?

- How can I reduce my taxes in Singapore?

Who needs to file income taxes in Singapore?

The long and the short of it is, if you’re earning an income and living in Singapore, you need to file taxes. These are the 3 basic criteria:

- Your total income for the preceding year was more than $22,000.

- You are self-employed and have received income with a net profit of over $6,000.

- You are a non-resident who has earned income from Singapore, regardless of the amount.

If you are working for a Singapore employer but are based overseas for work or largely travel for work, you still have to pay income tax in Singapore.

Just to be clear, this isn’t limited to folks working under an employer; even self-employed individuals earning income from gig work and freelance jobs are required to pay income tax. Other individuals who may need to file taxes include those receiving director’s fees, government grants, and trading gains from cryptocurrencies.

Anyway, you won’t be kept guessing because the government will inform you via a letter or SMS, sent by the Inland Revenue Authority of Singapore (IRAS) to your registered address and phone number.

Having said that, there are some exceptions, so if you’re not sure whether you’re eligible or not, use the IRAS online filing checker.

What are the income tax rates in Singapore for 2024?

The amount of tax you need to pay will depend on your tax residency status. Let us explain. All Singapore citizens and PRs living in Singapore for the majority of the time are considered tax residents.

Foreigners who have worked in Singapore for at least 183 days of the previous calendar year or 3 continuous years are also considered tax residents.

As long as you don’t fit any of the criteria above, you are considered a non-resident taxpayer. These include:

- Expats temporarily staying in Singapore for work assignments or projects for less than 183 days.

- Business owners who own Singaporean businesses but do not reside here.

- Investors who earn income from investments made in Singapore such as from rental properties and dividends from Singaporean companies.

- Foreign students working part-time jobs in Singapore but do not meet tax resident requirements.

Tax rates for resident taxpayers

Singapore follows a progressive tax rate system. This means that the more you earn, the more you pay – capped at 24%. As mentioned earlier, the minimum earnings to pay income tax is $22,000. So, if your employment income for the year is anything less than that amount, there’s no tax incurred.

Here are the tax rates for anything over $22,000:

| Annual Income | Tax Rate | Tax Payable |

| First $20,000

Next $10,000 |

0%

2% |

$0

$200 |

| First $30,000

Next $10,000 |

–

3.5% |

$200

$350 |

| First $40,000

Next $40,000 |

–

7% |

$550

$2,800 |

| First $80,000

Next $40,000 |

–

11.5% |

$3,350

$4,600 |

| First $120,000

Next $40,000 |

–

15% |

$7,950

$6,000 |

| First $160,000

Next $40,000 |

–

18% |

$13,950

$7,200 |

| First $200,000

Next $40,000 |

–

19% |

$21,150

$7,600 |

| First $240,000

Next $40,000 |

–

19.5% |

$28,750

$7,800 |

| First $280,000

Next $40,000 |

–

20% |

$26,550

$8,000 |

| First $320,000

Next $180,000 |

–

22% |

$44,550

$39,600 |

| First $500,000

Next $500,000 |

–

23% |

$84,150

$115,00 |

| First $1,000,000

>$1,000,000 |

–

24% |

$199,150 |

Tax rates for non-resident taxpayers

There are 2 different tax rates for non-resident taxpayers, depending on the type of income earned:

| Type of Income | Tax Rate |

| Employment income |

*whichever is higher |

| Director’s fee, consultation fees, and all other income | 24% |

Non-residents are also not eligible to claim any personal tax relief. However, you can claim tax deductions on donations to local registered charities and approved overseas emergency humanitarian assistance causes.

– How do I file my income tax return? –

Step 1: Wait for a message from IRAS in early March

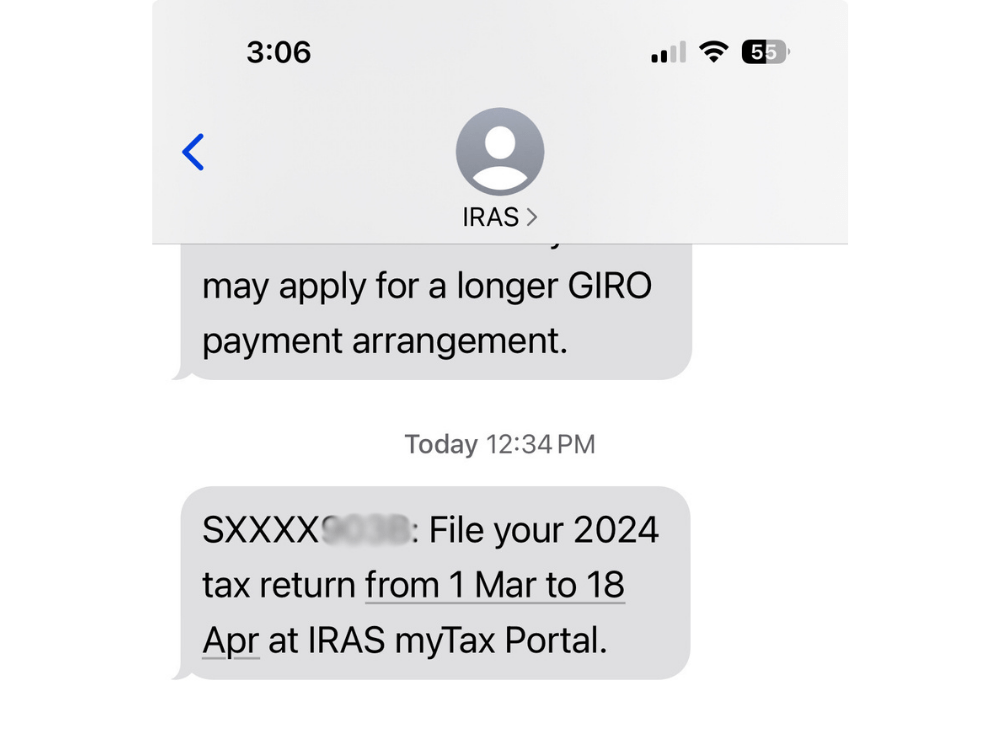

In the first week of March, you should receive a message from IRAS, either via SMS or letter, informing you to file your taxes before mid-April. This gives you about a 6-week window to file your taxes. And for most people, the process only takes about 15 minutes.

If you don’t receive either of these, it means you most likely don’t need to pay any income tax for the previous year. However, just to make sure, you can log into IRAS to find out. This notification is also dependent on the fact that you have updated your personal information such as mobile number and address in Singpass (App Store | Google Play).

There are some individuals who will instead receive an SMS stating that they have been selected for No-Filing Service (NFS). In such cases, you don’t need to file any taxes but can still log in to the portal to view your tax bill.

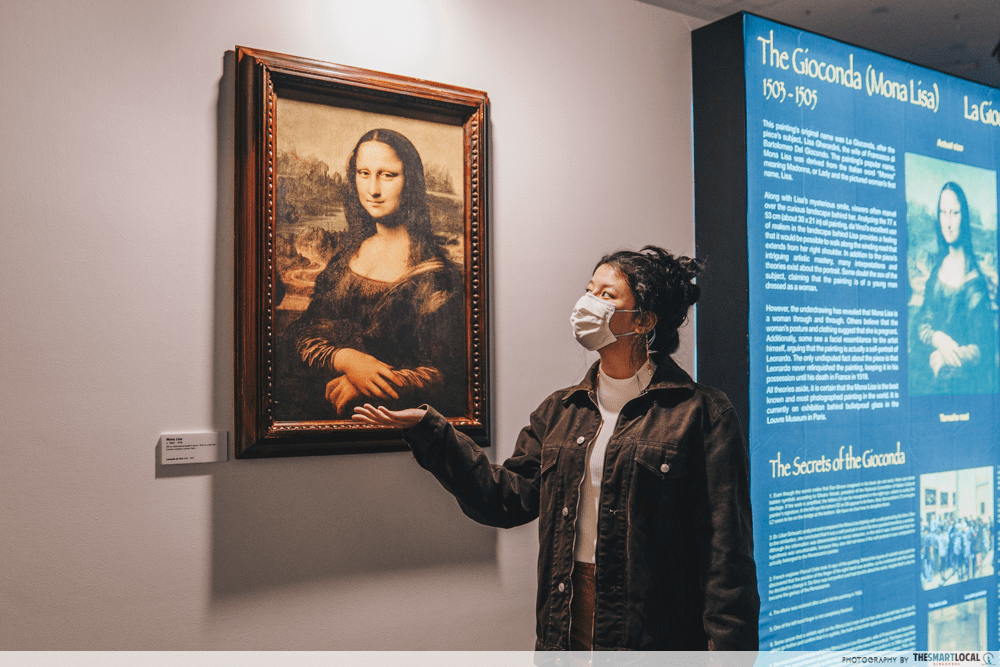

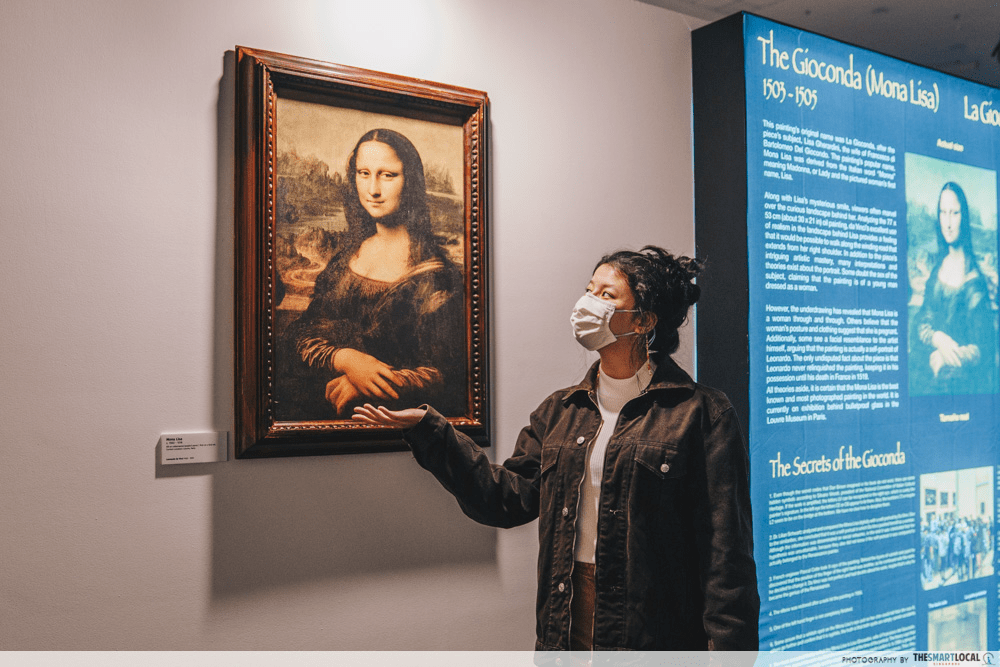

Step 2: Log in to myTax Portal & fill out personal details

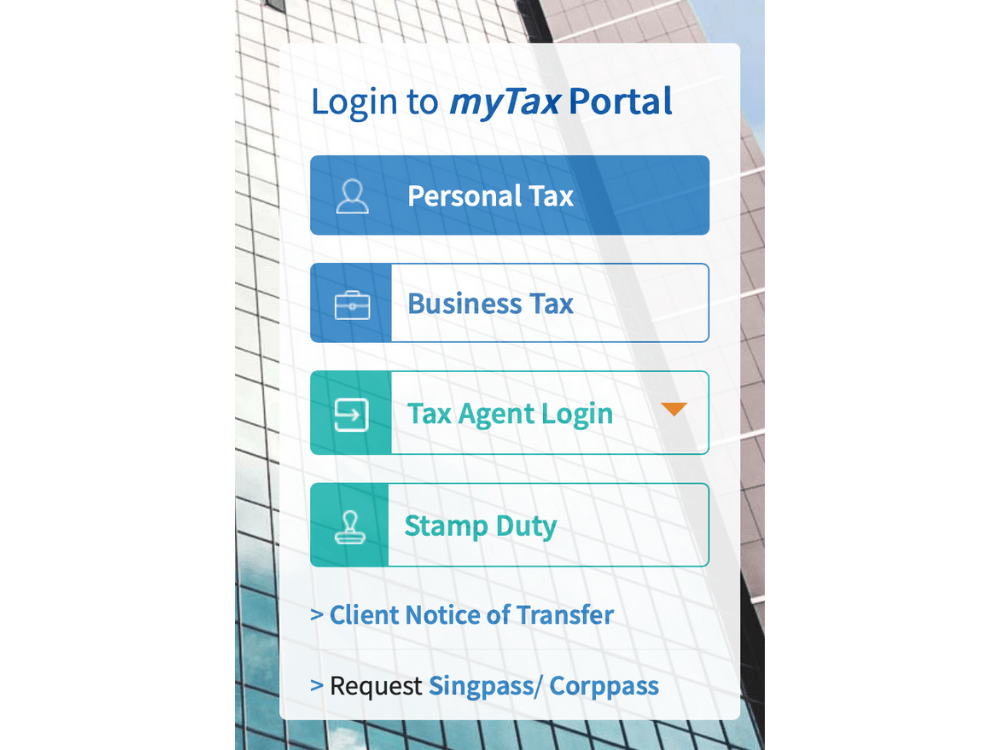

To declare your income for the preceding year, you’ll need to log in to myTax portal via Singpass. If doing so on mobile, it should be as easy as tapping on the QR code if you have the app installed.

Those who prefer to do this on the desktop need to have their phones nearby to scan the QR code or have their Singpass password handy if logging in using their NRIC.

Step 3: Fill out income earned

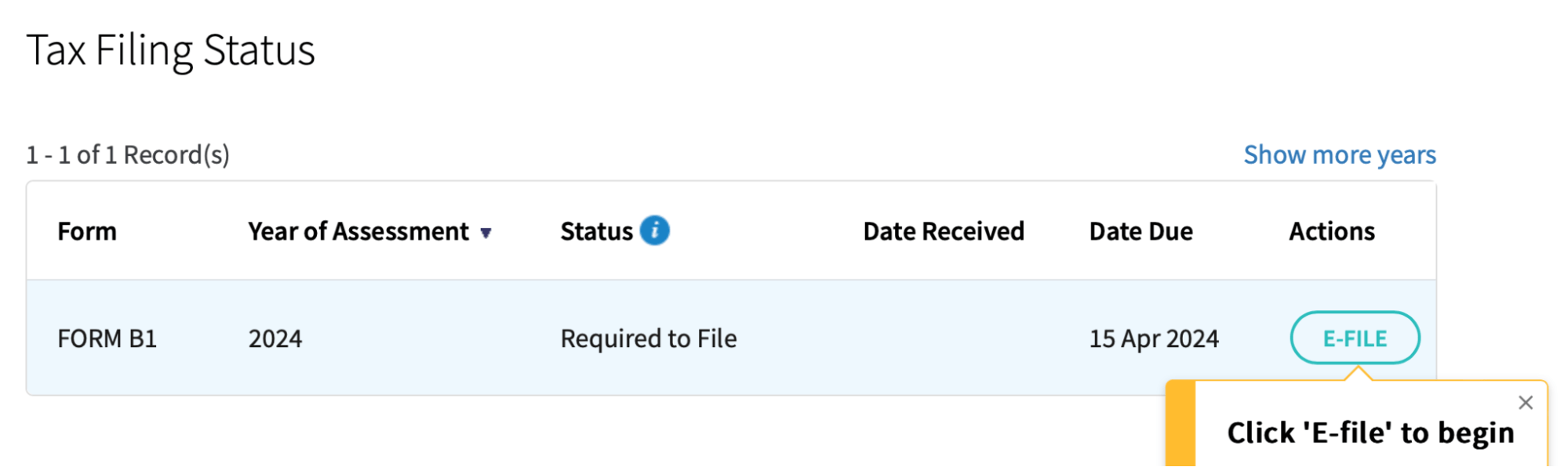

Once you’re in the portal, your tax filing status is the first thing you’ll see on the homepage. Form B1 is the one you need to fill out. Simply click on the “E-FILE” button to begin.

At any point, if you’re not sure how to go about computing the numbers, use the IRAS tax calculator to help you.

What if my employer is a part of the AIS?

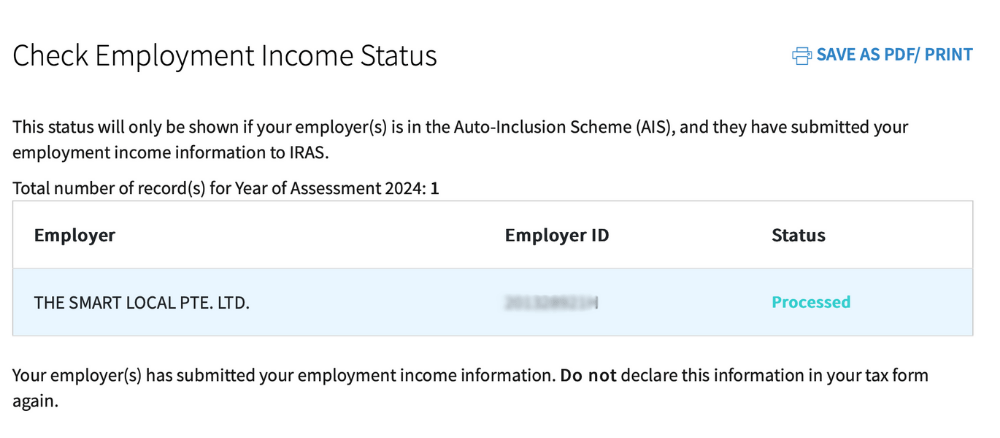

The process is really smooth if your employer is a participant in the Auto-Inclusion Scheme (AIS). In this case, there’s nothing you need to prepare in advance as all your employment income details will automatically be keyed into the system.

All you have to do is click into the form and verify that the information is accurate. Assuming all is well, you can preview your final tax bill before confirming that there will be no further changes.

However, if there is a discrepancy in the information provided by your employer, you will not be able to make any changes manually. Instead, you’ll have to inform your employer that the numbers are inaccurate and get them to amend the info on your behalf.

You can, however, add further information about income earned outside of your full-time employment such as from side hustles or renting out property.

What if my employer is not a part of the AIS?

Those who don’t see their employer’s name in the system have to manually enter their salary details. Your HR representative should have provided you with Form IR8A, stating all the information you’ll need during the tax filing process. Do check with your employer if you haven’t been given this form.

Form IR8A is a document prepared by your employer containing information on the remuneration you’ve received in the preceding year. It should look like an income statement consolidating all 12 months’ salary as well as performance and annual bonuses, if any.

Self-employed individuals

Now, if you are your own boss, then hopefully you’ve kept a record of all your earnings and expenses throughout the year. These include invoices, receipts, and bank statements. Consolidate these and add up the numbers to declare how much you’ve earned in the preceding year under the section “Trade, Business, Profession or Vocation”.

Although you don’t have to submit any documents when filing your income tax, authorities can call on you anytime to view the records as part of their auditing process.

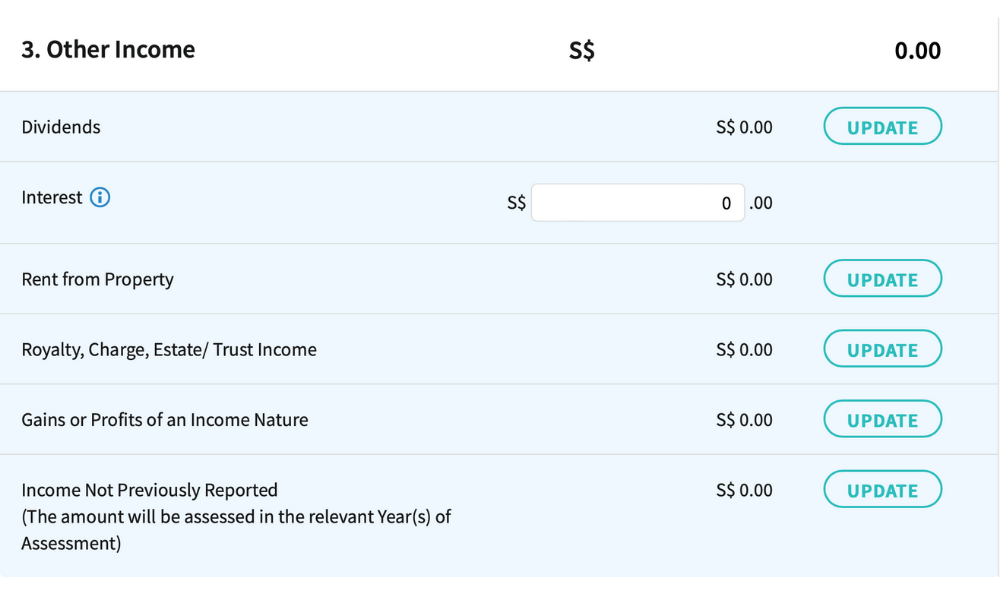

Declaring extra income such as from property rental

Apart from employment income, if you are getting extra income from other sources, these will have to be declared within the same form too. These include earnings from property rentals, dividends, royalty fees, and interest earned on deposits with non-approved banks in Singapore.

Checking personal tax deductions, reliefs & rebates

Only tax residents are qualified to claim for tax relief.

Only tax residents are qualified to claim for tax relief.

This last section of the form is where you might get to save some money by checking your eligibility for personal tax relief. There are 18 different reliefs one may be able to claim depending on whether you meet the criteria. Some common ones are NSman Relief, CPF Relief, and Foreign Domestic Worker Levy Relief.

One thing to note is that Earned Income Relief is automatically granted based on your age, so there’s no need to input anything for that column.

| Age the previous year | Maximum amount claimable |

| <55

55-59 >59 |

$1,000

$6,000 $8,000 |

Step 4: Make payment

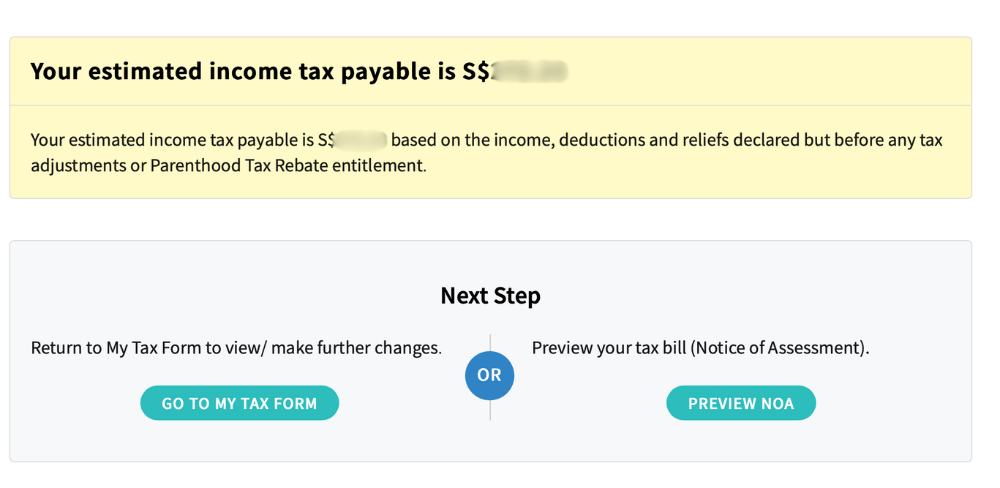

You’ve finally reached the end of the filing process. Once all income has been declared, the system will automatically calculate your income tax payable and allow you to preview your tax bill.

At this stage, you can still make any changes in case you forgot something or made a mistake. If you think that the final tax payable amount is incorrect, you may also file an Object to Assessment to dispute your case.

However, if everything has been finalised, then click on “Preview NOA” to view your Notice of Assessment (NOA).

This is where you’ll receive a breakdown of each section of the form for you to keep for your records. You’ll also notice that this year you’ve gotten a 50% tax rebate – capped at $200 – all thanks to Budget 2024. Now that you know how much your tax bill is, you have until 27th May 2024 to make the payment.

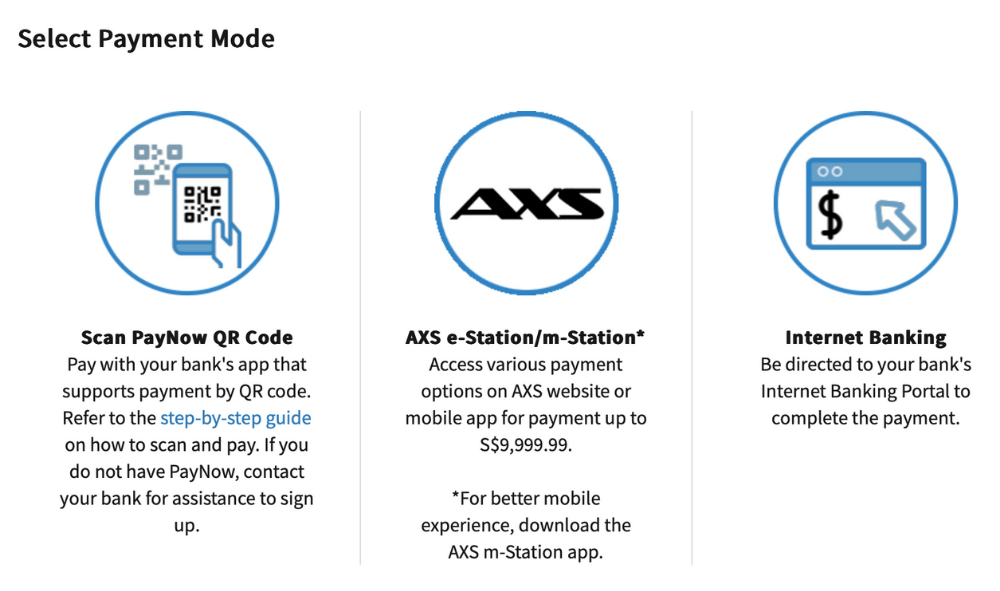

Doing so online is probably the fastest way and there are several modes of payment including GIRO, PayNow, PayLah!, and Internet Banking.

However, those who find apps and online systems a hassle, can also physically pay their taxes through AXS stations, SAM kiosks, ATMs, and SingPost branches.

Once that’s done, just sit tight and wait for an acknowledgement from IRAS which will be sent through the myTax Portal under the tab “Notices/Letters”.

– All your tax FAQs answered –

What happens if you don’t file income tax or forget to?

Take note of this date – 18th April 2024 – which is the deadline for filing your income tax. If you miss this deadline, IRAS will issue an estimated NOA based on your previous year’s income tax which you must pay within 1 month. If the NOA is incorrect, you’ll then need to file an objection within 2 months of the issue date.

In case you’ve just missed the deadline for filing, you can request for an extension for up to 14 days through the myTax portal.

The consequence for late payment or not paying your taxes is a 5% penalty fee. You can appeal for a waiver of this penalty fee for authorities to consider, provided you’ve already paid your taxes in full.

Should you fail to pay your taxes for 2 years or more, you may be summoned to court and ordered to pay up to twice the amount of tax assessed and up to $5,000 in fines.

What is not taxable in Singapore?

Well, there are certain personal earnings that you don’t need to declare during this filing process. These include:

- Winnings from buying TOTO and 4D

- Gains from the sale of a property

- Profits from buying and selling of shares or other financial instruments for investment purposes

- Payouts from insurance policies

How can I reduce my taxes in Singapore?

No, we’re not referring to tax evasion here; there are numerous legal ways to reduce your income tax. For example, do some good by making cash donations to registered charities in Singapore and this will make you eligible for a tax deduction.

You can also donate valuable artefacts and artwork to the National Heritage Board that will be displayed for public viewing. Particularly wealthy folks with spare properties can donate buildings to welfare groups such as animal shelters.

Voluntary top-ups to your Medisave account or family members’ CPF accounts, as well as contributions to your retirement fund also grant you tax relief.

File your income tax before the deadline

We know, we know. Filing taxes doesn’t sound like the most fun activity but let us assure you that the myTax portal makes it pretty easy. As long as you follow the steps closely, the process should be a breeze. In any case, if you still need further help, you can pick the brains of IRAS’ chatbot on their website.

File your income tax on IRAS

Contact: 1800 356 8300

More adulting guides:

- What to do when you are laid off

- HDB cleaning tips

- How to choose a mattress

- Important home renovation questions

Originally published on 22nd March 2024.