Personal finance tips

You could say that stepping out of school and into the working world is like jumping out of the frying pan and into the fire. It’s a new world with new problems, and perhaps the most intimidating hurdle for all non-money-savvy folks is the dreaded topic of finance.

After getting that first paycheck, it’s time to think about how to handle all that incoming moolah. If you have zilch idea about what things like “corporate benefits” mean, or are still living out of your everyday savings account that you’ve had since primary school, here are some personal finance tips from older Singaporeans who have gone through it all:

Disclaimer: Tips are based on the interviewees’ personal experiences. Write-up and quotes have been edited for clarity.

– Spending –

1. Offer to pay first with a credit card when dining out to earn cashback

With a steady stream of income comes a tiring 9-to-6 schedule and heading out for a nice meal with friends is something you may catch yourself doing time and again. But if you find the numbers on your receipt hard to swallow, there’s an easy way to lessen the damage: credit card cashback.

Not everyone has a credit card while in their 20s, but if you do, offer to pay first when dining out as a group as a kind gesture, says Winson Chin, 33. The cashbacks will be credited back into your card, and you will be able to spend it on something else or save it for a rainy day.

There are plenty of credit cards out there, each with different benefits. But for young folks, Chin recommends the DBS LiveFresh Card, which he’s currently using. This comes with up to 5% cashbacks for Visa contactless spend and online purchases – i.e. most of the things that feed our millennial needs.

Also check out our guide on how to waive credit card fees.

2. Download a free expenses tracker app like Expense Manager

Ignorance, unfortunately, isn’t always bliss. When it comes to managing your expenses, calculating your expenditure is a necessary pain, according to Kayce Teo, 35. “It’s a bit like if you want to lose weight; you have to count the calories.”

Of the many ways you can track your numbers, one fuss-free method is to download an expenses tracker such as Expense Manager (Android) on your phone. All you then have to do is to promptly key in every dollar and cent each time you make a purchase. Tell yourself: “Pain is gain”.

“It made me think twice about buying anything at all, because of the additional accountability,” says Teo. And hey, while instant gratification might not hit the same anymore, at least you’ll have more savings for future necessities, which’ll serve you well in the long run.

Other free and highly-rated expense trackers to consider include Monefy (iOS, Android) and Money Manager Expense & Budget (iOS, Android)

3. Approach your company’s HR for corporate benefits

“Corporate benefits” is a term most of us are exposed to once we start working, and unlike schools, perks don’t always come laid out on a silver platter. Many companies, especially larger MNCs, tend to offer staff perks such as discounted gym memberships, corporate mobile plans, and medical benefits.

To avoid missing out on all the good stuff, approach your HR as they’ll usually be the first point of contact for the details, says Nirelle Goh, 39. These perks may not seem like much on their own, but these miscellaneous spendings can add up in the long run. Making the best use of your workplace perks can thus save you a hefty sum.

4. Always make purchases with “rewards apps” like Shopback

Cutting down on your expenditure is the best way to increase your savings, but you don’t necessarily need to scrimp it out just to save some money. With a little bit of effort and time, you can still enjoy the finer things in life – like bubble tea – without scooping too much into your savings.

“Before you spend any money, make sure it’s the best use of your dollar,” says Terence Ang, 30. “For example, bubble tea can get pretty costly with $5 to $6 per cup. But there are many deals out there that offer discounts that bring it down to $1 to $3 if you look at the right places, like Shopee and Shopback. I rarely pay retail prices for most of my purchases now.”

It may seem pretty duh, but most of us forgo a quick search in favour of convenience. “If it’s just a minute to save $3 to $4 off a purchase, why not do it?” he adds.

5. Quell impulsive purchases by creating a new savings account

Impulse buys are perhaps the greatest enemy of good savings habits. If smaller measures like expense tracking aren’t quite solving the problem, consider visualising your savings more clearly with a bank account dedicated solely to curb impulsive buys.

Says serial shopper and snacker Huy Pham, 30: “Every time you feel the urge to buy something you want, transfer that amount into a separate savings account instead. It helps you see how much you can actually save by not splurging, and at the same time, you’ll also feel the pinch as the money leaves your main bank account ”, he says. “I saved about $500/month the last time I tried it.”

– Savings & loans finance tips –

6. Set up a standing order to transfer a set amount to a savings account monthly

An account for impulsive buys aside, a more common way to save more is to set up a standing order to transfer a set amount of savings to a dedicated savings account every month.

“It’s useful to have one account for spending and one strictly for savings so you don’t accidentally overspend,” says Jean Lai, 35, echoing the sentiments of many folks when it comes to improving saving habits.

You can do this easily on most online banking sites, but do note that the same function goes by various names such as “standing instruction” or “recurring transfer”, depending on the bank. As a rough gauge, at least 30% of your income is the recommended amount that should go towards your savings.

7. Start on fixed deposit plans in your early 20s to make HDB down payments easier

Image credit: TheSmartLocal

Image credit: TheSmartLocal

Getting a home to call your own is the dream, but housing is never cheap – and while a loan from the Bank of Dad & Mom might be in the picture, it’s also helpful to start saving up for it as early as possible.

Jessica Fang, 31, now living in a HDB maisonette, recommends signing up for fixed deposit in your early 20s if you’re financially secure and free of loans, rents and other financial commitments. “This will help you slowly build up your interest so by the time you hit 30 or 35 and are ready to buy a house, the 10-25% down payment won’t be so painful”

“I didn’t invest in this, but I wish I did, especially since some of them have pretty short tenures. It would have made saving up for a wedding, house and renovations a bit more bearable,” she adds.

Pro-tip: While long-term fixed deposit plans offer higher returns, there are also short-term plans with a tenure as short as one month if you’re unable to lock your money for an extended period.

8. Credit your income to high interest-bearing accounts

Even if you can’t commit to any other tip in this list, the one thing you’ll need to do is credit your income to a bank account with higher interest rates.

Once you have a stable income, the doors to better interest rates open. Switching things up from the measly ~0.05% of an ordinary savings account is a basic step that many take a while to figure out, but is universally agreed upon to be a must-do.

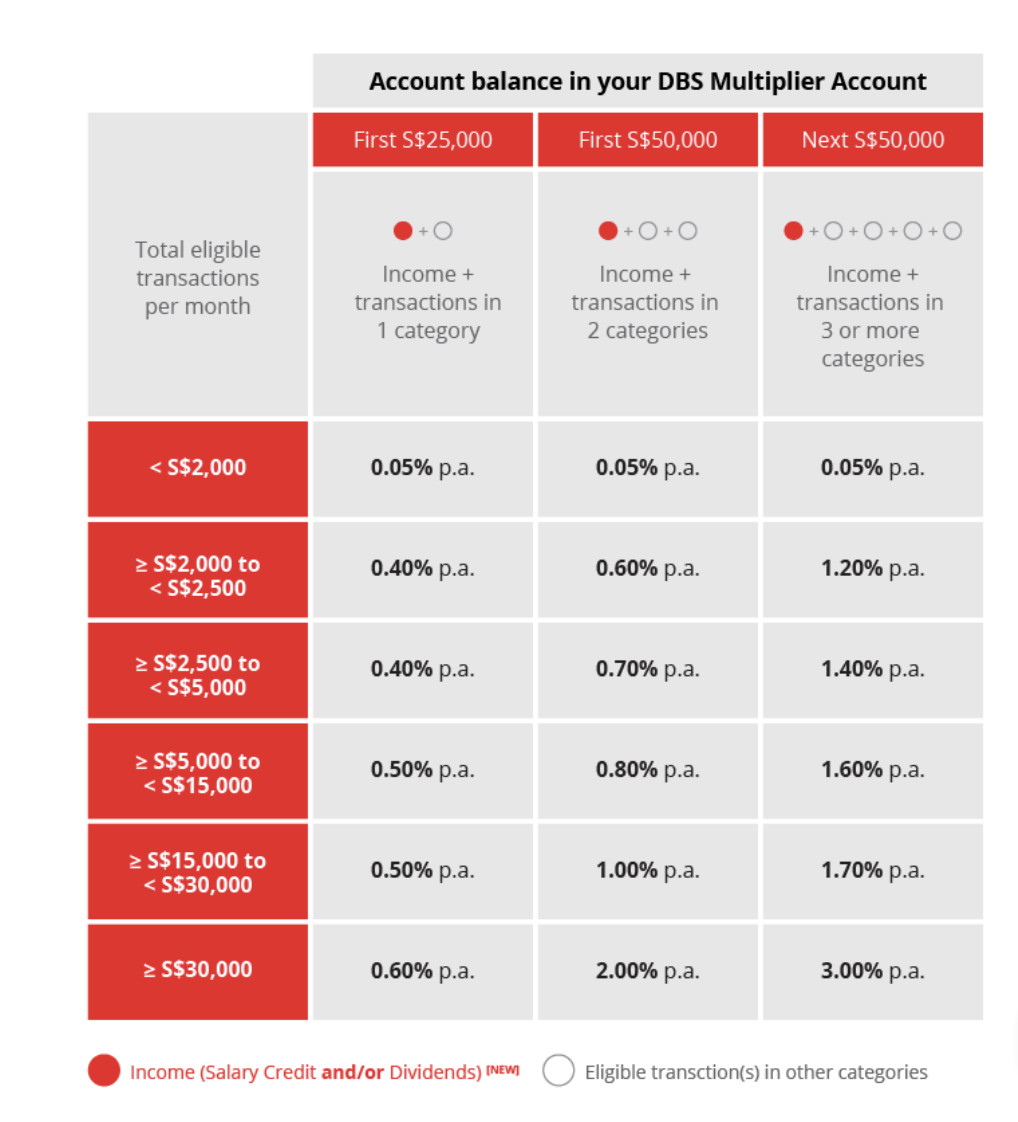

DBS Multiplier

For POSB/DBS users out there, an upgrade from your e-Savings account would be the DBS Multiplier account which you can set up on their iBanking website; no lengthy trips to the bank needed.

“If you have the cash and want to start somewhere, DBS Multiplier is a good start because the interest rates are not bad for beginners,” says Kaitlyn Leow, 38.

How it works is pretty simple in principle: the more categories of transactions you hit per month, the higher your interest rate – which goes up to 3% per annum. It varies according to this table:

Crediting your salary of ~$3K + credit card spend of more than $500/month = 0.4% p.a. interest rate.

Image credit: DBS

9. If you own a house, look into refinancing home loans when possible

You know the drill: grow up, get married, get a HDB and live happily ever after. For most of us looking to own a home, getting a housing loan is a rite of passage. HDB offers concessionary loans, and it’s likely the comfortable choice that many folks pick.

But as Winson Chin shares, it’s always important to weigh your options. “Always compare HDB with bank loans. At different points in time, bank loans could be cheaper, so refinancing it over at the right time would save more,” he adds.

If you’re already with a bank, there’s also the option to reprice your home loans if a more attractive package within the same bank comes up. But remember to also keep in mind the lock-in period – this is the set period of time whereby you’re committed to your loan. It usually ranges between one to five years, and a penalty will be incurred if you withdraw before the stipulated end date.

– Insurance finance tips –

10. Buy MINDEF insurance for your family from $5.10/month

Purchasing your first insurance plan can be tricky as there are likely many financial advisors and agents out there with a plethora of plans to choose from. If you’re looking for a super-basic one to tide you through, the MINDEF Group Personal Accident policy under Singlife – previously AVIVA – priced from an affordable $0.17/ day or $5.10/month. This offers up to $1 million in coverage against accidental injuries.

“It’s much cheaper than other insurance policies, although the coverage is lower,” says Charles Tan, 65. It’s also worth noting that he also has other insurance policies to supplement his family’s MINDEF policy.

The good news is that this isn’t just open to MINDEF and MHA members. Members can also purchase the plan for their spouse and children to have the whole jingbang covered.

Find out more about MINDEF and MHA’s insurance schemes.

11. Purchase life insurance plans in your early 20s

Life insurance is a term you’ll begin to hear as you hit the adulting phase. If you’re wondering what on earth it even means, here’s a quick definition: A life insurance is a contract whereby you, a policyholder, pay a regular amount to an insurance company in exchange for a sum of money promised to your family should you pass on.

Most buy life insurance when they have family members such as ageing parents or young children, depending on their income. But the thing you’ll need to know at the tender age of your 20s is that the cost of the plans increases every year. The earlier you get it, the cheaper the annual premiums cost, tips Eliza Tan, 31.

As a rough gauge, the premiums for a healthy non-smoking 24-year-old starts from $500/year, but varies depending on things like the sum assured, premium term and premium type. For a 27-year-old, it starts from $545/year.

You can calculate a rough premium price on online calculators like Compare First, but before buying anything, it’s always best to consult your financial advisor for a second opinion.

– Investing finance tips –

Disclaimer: All investment recommendations are not foolproof, and the advice given below is all based on each individual’s personal experiences.

12. Invest with as low as $100 once you have 6 months of emergency funds

If you haven’t already, set aside a quick 5 minutes and calculate the amount of emergency funds you’ll need by taking your monthly expenditure – bills and loans included – and multiplying it by 6 months. This is the estimated minimum liquid amount you should readily have to last you through an emergency, such as the loss of a job.

Once you have that amount set aside, you can consider investing some of the rest, advises Jean Lai, 35. Contrary to popular belief, you don’t need a monstrous sum to start investing – with just $100, start dipping your toes into the shallow end of the investing pond.

For beginners, Thomas Lim, 34, and Yee Chong Pang, 55, both recommend the passive and low-risk broad market Exchange Traded Funds (ETFs). “I put 25% to 30% of my income into investments and automate a portion of my monthly salary portion to invest in ETFs,” shares Lim. “You don’t have to look at the stock price every day as well.”

Other beginner-friendly options to consider include Blue Chip Shares and Unit Trusts. Beginners can read our guide to finance terms for noobs, where we break down complicated finance jargon.

13. Singapore Savings Bonds & T-Bill are the most noob-friendly

If you simply cannot deal with numbers, there are 2 words you need to know: “government bonds”. Singapore Savings Bonds (SSB) are backed by the Singapore government and are known to be stable, predictable, and most importantly, noob-friendly. You can apply for it easily via internet banking on major banks like DBS/POSB, OCBC, and UOB.

Every month, a new SSB plan is offered with varying interest rates, usually around 2%-4%, with projected 10-year returns. “You need a minimum of $500 to sign up, and then just sit back and collect interest rates for years,” says Sam Lee, 30.

Compared to fixed deposits, you can also withdraw your money without a penalty. All you need to do is submit a request through your internet banking portal.

T-Bills are similar to SSB with the main difference being that you can use your CPF to invest in it. However, you can’t redeem your investment earlier than agreed.

14. Read financial blogs like Investment Moats to stay interested in the finance world

Chances are, you ain’t no Wolf Of Wall Street and don’t have the latest insider news like John Belfort does. Which is why it’s important for those outside of the business world to regularly put in the effort to keep up to date with the latest financial happenings – especially if you’re looking to actively invest in more volatile stocks.

Apps like SGX (iOS, Android) and InvestingNote (iOS, Android) can help you keep track of the latest stock market prices, but if you’d like information in easily digestible forms, try reading blogs like Investment Moats, says Janice Tan, 30. “Having interest in the business world as a market as a whole is important, you wouldn’t want to fall asleep while at it.”

Pro-tip: Follow Telegram groups like Bloomberg, SGX invest, SG market updates for updates on the go.

For more investment tips, read:

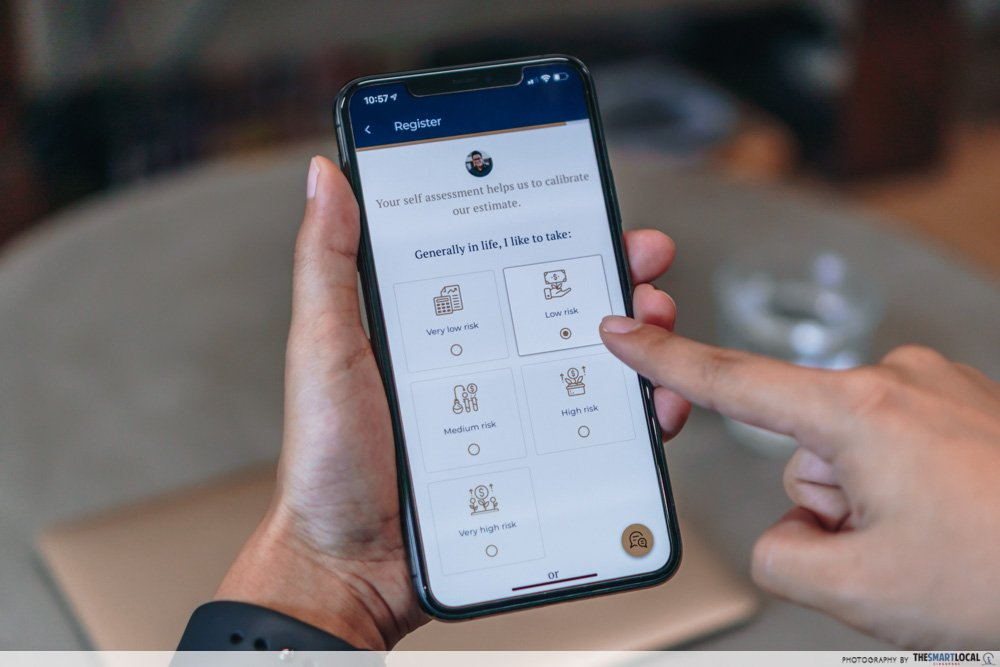

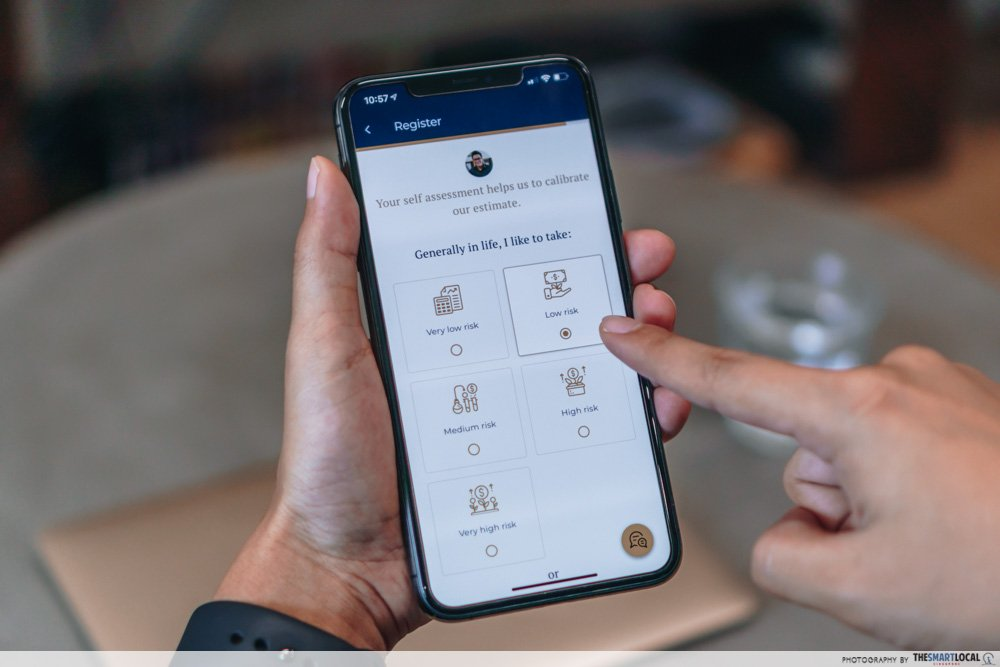

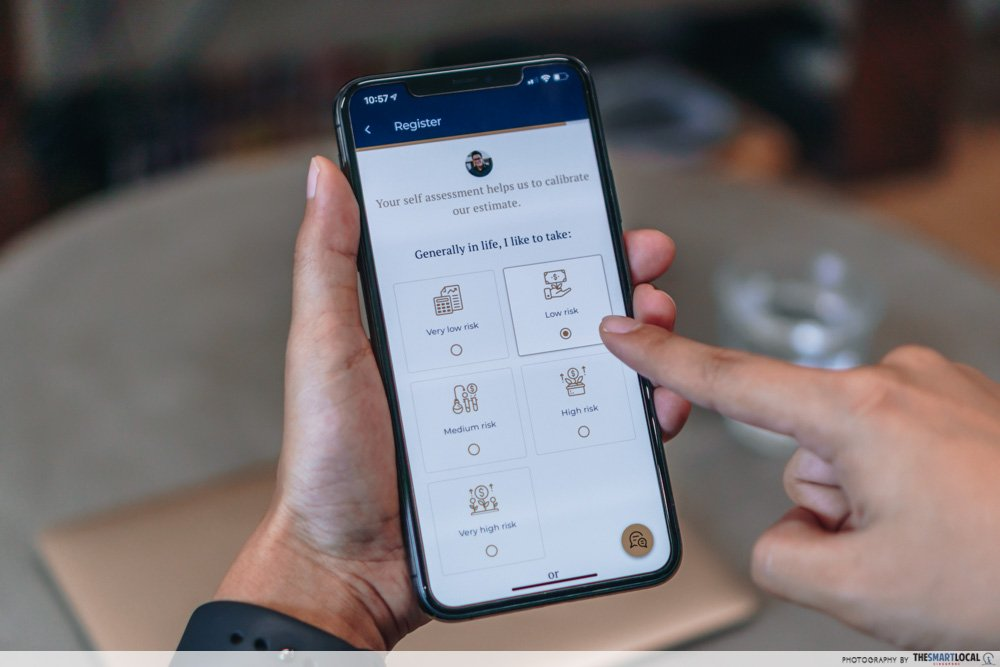

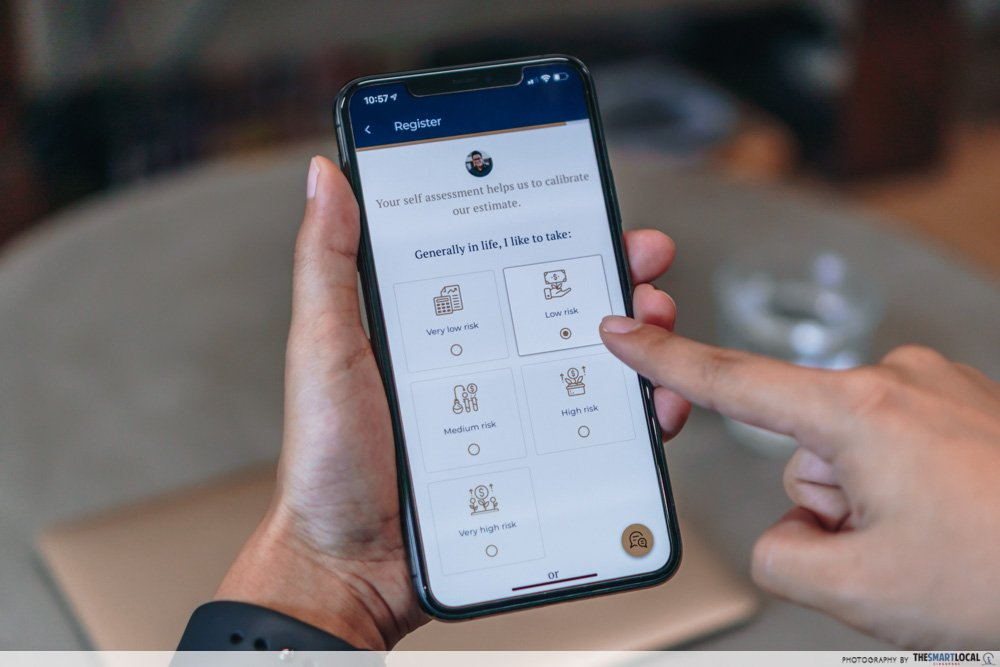

15. Syfe Cash+ offers returns comparable to other FAs but with more liquidity

While highly liquid assets may convert into cash easily, they tend to have little appreciation. Jack Foo, 31, recommends Syfe Cash+ (iOS, Android) – a low-risk investment app that has been gaining in popularity because of its relatively high interest rates for its liquidity.

“There are some investments from other financial assets* that offer good returns for five years. I’m tempted, but there are commitments in the future like a wedding and house,” he says.

This app, on the other hand, offers a projected rate of 1.75% with no minimum deposit, no management fees and unlimited free transfers and withdrawals anytime – great for those unable to lock in a lump sum.

However, he also notes that the rates offered by similar investment apps – such as Stashaway and Endowus – change frequently. A pro-tip is to keep track of their rates and actively port everything over to the one with the highest offer.

*Financial Assets (FAs) are liquid assets, a.k.a. money that can be moved around easily such as bonds and stocks – rather than properties, vehicles and intellectual property.

How to manage your money, according to Singaporeans

It’s not easy managing your own money well, but little tips from experienced folks go a long way in helping all of us beginners start off on the right foot. So take a page out of these folks’ books and start early to sort out your personal finances – the sooner you plan, the better!

For more personal finance tips and guides:

Cover image adapted from: TheSmartLocalThis article was originally published on 18th February 2021. Last updated on 26th April 2024.