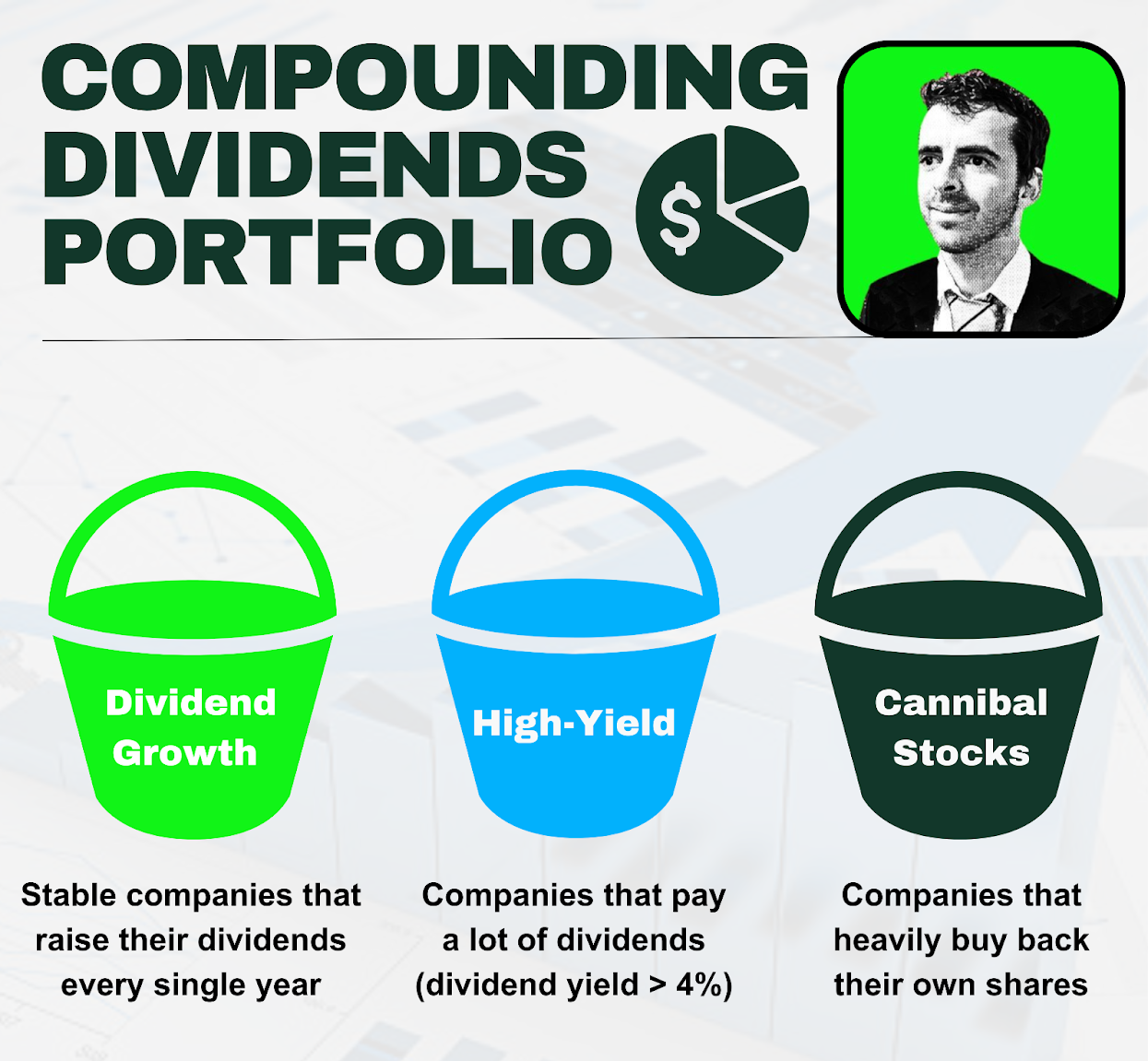

Today, we are launching the Compounding Dividends Portfolio.

This means we will buy our first stock.

Let’s walk our investment journeys together and build a great portfolio!

Portfolio Rules

Good agreements make good friends.

Because we are Partners, I will treat you just the same way I would like to be treated.

“We have an attitude of partnership. Charlie Munger and I think of our shareholders as Owner-Operators.” – Warren Buffett

Here are the Portfolio Rules:

-

You can follow the Portfolio 24/7 with 100% transparency

-

REAL money is invested in the Portfolio (skin in the game)

-

The portfolio will be based on a (fictional) amount of $1 million

-

For each company and transaction, you’ll see what percentage we’re investing

-

This way, you’ll understand our confidence in every company and transaction

-

-

No front-running

-

Compounding Dividends will never buy a stock before you have the chance to do so (after doing your own research—please read the disclaimer

-

We’ll announce new transactions during the weekend, and they will be executed the next trading day (on Monday)

-

First Stock

The first stock we’ll buy is a Dividend Growth Stock:

-

The company has a beautiful franchise model that creates good returns for the parent company, and incentivizes the franchisees in all the right ways

-

It has plenty of room to grow internationally

-

The company has a strong loyalty program that has created a flywheel effect that will also allow the company to open a lot more US stores

-

It’s trading above its historic dividend yield and has a history of intelligently buying back shares

Let’s dive into the 37-page Investment Case and prepare our transaction for Monday.

Today, we are launching the Compounding Dividends Portfolio.

This means we will buy our first stock.

Let’s walk our investment journeys together and build a great portfolio!

Portfolio Rules

Good agreements make good friends.

Because we are Partners, I will treat you just the same way I would like to be treated.

“We have an attitude of partnership. Charlie Munger and I think of our shareholders as Owner-Operators.” – Warren Buffett

Here are the Portfolio Rules:

-

You can follow the Portfolio 24/7 with 100% transparency

-

REAL money is invested in the Portfolio (skin in the game)

-

The portfolio will be based on a (fictional) amount of $1 million

-

For each company and transaction, you’ll see what percentage we’re investing

-

This way, you’ll understand our confidence in every company and transaction

-

-

No front-running

-

Compounding Dividends will never buy a stock before you have the chance to do so (after doing your own research—please read the disclaimer

-

We’ll announce new transactions during the weekend, and they will be executed the next trading day (on Monday)

-

First Stock

The first stock we’ll buy is a Dividend Growth Stock:

-

The company has a beautiful franchise model that creates good returns for the parent company, and incentivizes the franchisees in all the right ways

-

It has plenty of room to grow internationally

-

The company has a strong loyalty program that has created a flywheel effect that will also allow the company to open a lot more US stores

-

It’s trading above its historic dividend yield and has a history of intelligently buying back shares

Let’s dive into the 37-page Investment Case and prepare our transaction for Monday.

Today the Compounding Dividends Portfolio launches with a dividend growth stock. The company has a beautiful franchise model that creates good returns for the parent company, and incentivizes the franchisees in all the right ways. It has plenty of room to grow internationally. The company has a strong loyalty program that has created a flywheel effect that will also allow the company to open a lot more US stores. It’s trading above its historic dividend yield and has a history of intelligently buying back shares