While the Singapore Savings Bonds (SSB) may not sound like the sexiest investment for growing our wealth, its popularity has recently increased – mainly due to rising global interest rates – compared to when it was first issued in 2015. Against the backdrop of a higher for longer interest rate environment, many of us have come to see it as a part of our investment portfolio or are thinking of investing in it.

In line with the higher interest rate environment, interest rates on other similar bond-type investments have also risen. For example, our CPF Special Account (SA) and MediSave Account (MA) are paying 4.08% p.a. (from Jul 2024 to Sep 2024), while the 6-month treasury bills are paying 3.13% p.a. (auctioned on 29 Aug 2024). In the U.S., the 6-month treasury bills are yielding 4.865% p.a (as of 26 Aug 2024).

Read Also: 6 Month Vs 1-Year Treasury Bills: Understanding The Differences And Choosing The Right Option

What Are Singapore Savings Bonds (SSBs)?

Singapore Savings Bonds (SSBs) are issued every month by the Singapore government via the Monetary Authority of Singapore (MAS). It was first offered to retail investors in October 2015. The SSBs have a maximum tenor of 10 years, usually paying a step-up interest return each year to reward investors who hold it for a longer period. Both Singaporeans and foreigners can invest in SSBs.

We have to invest in multiples of $500 when buying SSBs, and can purchase up to a maximum investment limit of $200,000 worth of SSBs. We have to pay a $2 transaction fee for each SSB application. Similarly, when we divest our SSBs, we also need to withdraw in multiples of $500, and it does not have to be for the full amount we invested. When we redeem our SSBs, the proceeds will be credited into our account on the 2nd business day of the following month. We still receive a pro-rated interest for any withdrawals we make rather than lose all interest payments for any period. We can redeem our SSB investments at any time without any penalties, except for a $2 redemption fee each time.

SSBs pay interest returns every six months, on the first business day of the month. If no redemptions are made, the principal and last interest payment will be automatically credited to our bank account, which is linked to our CDP account, after the 10-year maturity period. The interest payments we receive from the SSBs are tax-free.

Read Also: 5 Reasons Why It Makes Sense To Invest In Singapore Savings Bonds (SSBs)

Within the 10-year period, the interest rates we receive on the Singapore Savings Bonds “step-up” every year to give us a better return for each year we leave our money in the SSB. For example, in the latest September 2024 (SBSEP24 GX24090E) SSB issuance, individuals had to apply by 27 August 2024, 9pm and its annual returns are:

Year From Issue Date

Interest

Average Return Per Year*

1

3.06%

3.06%

2

3.06%

3.06%

3

3.06%

3.06%

4

3.06%

3.06%

5

3.06%

3.06%

6

3.06%

3.06%

7

3.09%

3.06%

8

3.17%

3.08%

9

3.21%

3.09%

10

3.21%

3.10%

*At the end of each year, on a compounded basis

Source: Singapore Savings Bond Website

Interest rates tend to rise the longer we remain invested. Recently, this effect has been muted due to the current interest rates environment, i.e. an inverted yield curve. As we can see in the example above, the latest September 2024 SSBs are paying a flat return of 3.06% per annum for the first 6 years, and only step-up marginally between the 7th and 10th year. Throughout its 10-year tenor, the average return is 3.10%.

Read Also: Should You Invest In The SSB For Its 1-Year Interest Rate Or 10-Year Average Return?

Singapore Savings Bonds (SSBs) Returns Reflect The Interest Rate Environment

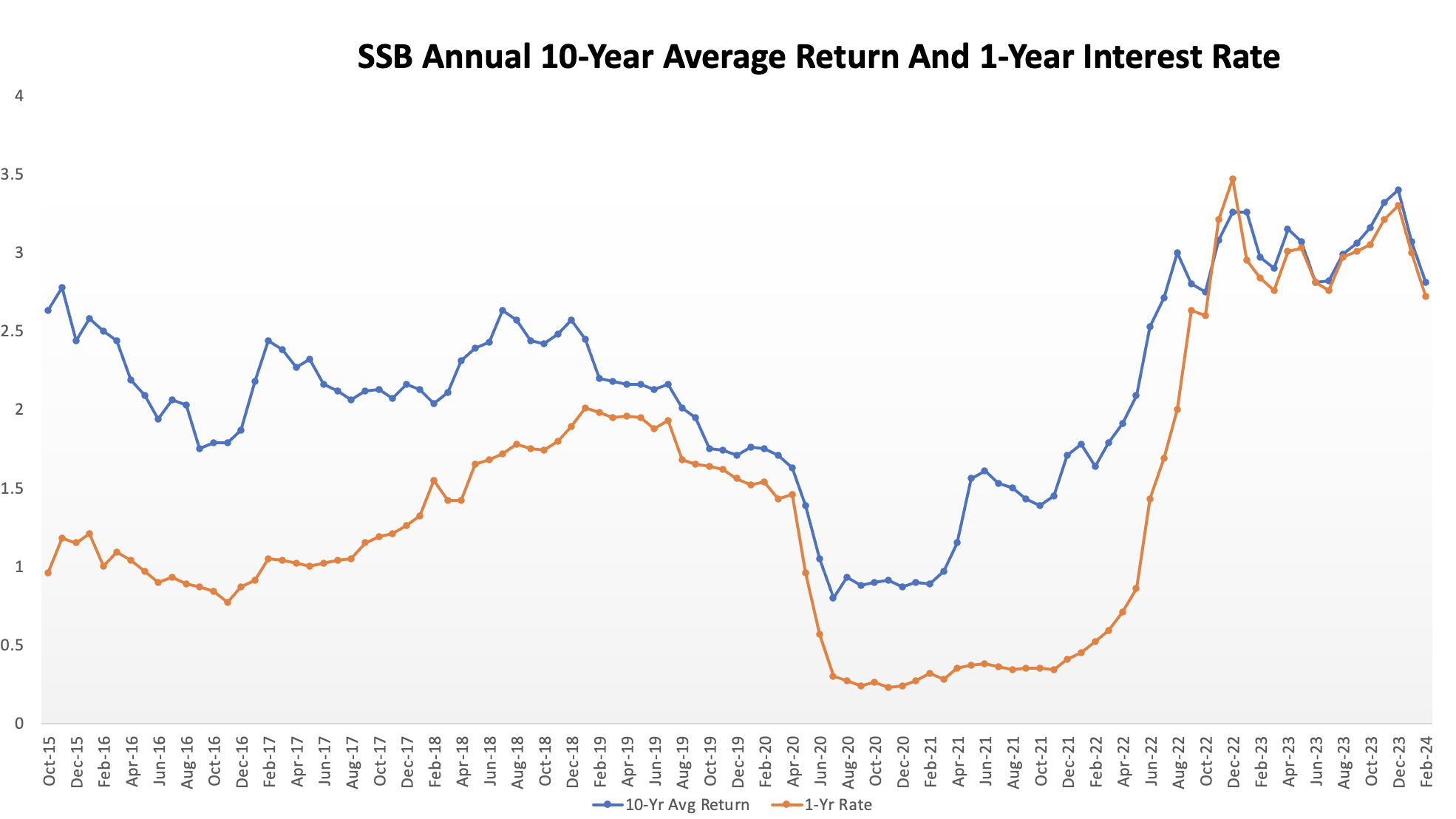

We chart both the 1-year and 10-year SSB interest rates since it was launched in October 2015 to depict the movement of interest rates for the investment.

In the initial months, the average 10-year interest returns hovered around the 2.5%-mark, which is what our CPF Ordinary Account (OA) also paid as a floor rate.

In the subsequent year, the 10-year rate dropped to under 2.0%, reaching a low of 1.75% in September 2016. From there, interest rates gradually recovered to the 2.5% and 2.6% range in 2017 and 2018 respectively. However, from 2019 to 2021, the average 10-year interest rate trended lower and hit the lowest point in July 2020 – offering a mere 0.80% per annum.

In 2022, due to rising inflation beyond the target level, the US central bank (the Fed) began to reverse its monetary policy by raising interest rates. The SSB has also started to reflect the general interest rate environment, with long-term (10-year average returns) rates rising to an all-time high of 3.47% in December 2022.

While the 10-year rates have hovered above the 3%-mark since then, they have marginally fallen. The most recent September 2024 SSB issue offered 3.10% for its 10-year average returns. This is likely due to expectations that the Fed is likely to introduce rate cuts in 2024 and 2025.

Read Also: How Is The Interest Rate Derived For The Singapore Savings Bonds (SSB) And Why It Is Increasing?

Why Should People Consider Investing In The Singapore Savings Bonds (SSBs)?

Even though SSBs tend to generate lower returns than stocks in the long term and even T-bills in the short term, there are still a few good reasons to invest in them:

#1 Risk-Free Investment

Backed by the government of Singapore, which has been accorded a strong credit rating by international credit rating agencies, including Moody’s, S&P, and Fitch, the Singapore Savings Bonds is virtually risk-free. This means investors do not have to worry about any capital loss or interruptions in the payment of interest rates.

Read Also: 6 Investments In Singapore That Provide Guaranteed Principal And Returns

#2 Flexibility To Keep Investments For The Long-Term Or Re-Invest In The Short-Term

Investing in the SSB give us great flexibility to earn a decent yield in the short-term, as well as lock-in a decent yield in the long-term. For example, if we had invested in the September SSB issue, we would be able to start earning a short-term 1-year interest of 3.06% p.a.

At the same time, we are locking in a longer-term interest return of 3.10% p.a. without any obligations to stay invested. If interest rates drop steeply, we can always stay invested and enjoy a higher return. If interest rates rise steeply, we retain the flexibility to sell our SSBs, get our funds by the 2nd business day of the following month, and reinvest at a higher interest rate.

#3 Diversification For Our Investment Portfolio

The Singapore Savings Bonds is a government bond. This means we can diversify our investment portfolio if it is made up of just stocks, or even if it includes bonds issued by companies, which are not risk-free.

#4 High Liquidity

Even though they’re termed as bonds, we retain a high level of liquidity by being able to withdraw our investments at any time, with no penalties other than a $2 redemption fee. We will receive our money by the 2nd business day of the following month after we make redemptions.

This gives us the ability to earn higher interest rates on our emergency funds and also any savings we are not sure when we will need to use (for wedding, renovation, holiday… etc). We can do this without losing much liquidity as the SSBs can be redeemed within one month and without risk of losing any of its value due to market movements in interest rates.

An added perk is that we can always withdraw these funds whenever we see a higher interest rate being paid on subsequent SSB issues, or if we spot an opportunity in the financial markets.

The same cannot be said of most bonds, even other Singapore Government Securities, which are traded at market value (which can move higher or lower) if we need to withdraw from our investments early. These can be significantly different from our principal sum, especially in a low-interest rate environment with unpredictable longer-term interest rate movements.

#5 We Can Invest From As Little As $500

Also mentioned earlier, we can start investing in the Singapore Savings Bonds from as little as $500. Many corporate bonds in the market require us to invest $100,000 or even $250,000 in them. Even for other Singapore Government Securities, we still need to invest from $1,000. Many retail bond products also tend to require slightly higher investments of $1,000 or $2,000 and above.

Read Also: Step-By-Step Guide To Bond Investing In Singapore

#6 Regular Interest Payments

With interest payments every six months, we have visible cashflows, and we can plan our expenses around these interest payments. This is especially relevant if we are using it to supplement our retirement income.

We can also view our Savings Bonds portfolio on a single dashboard by logging in with our Singpass from the Singapore Savings Bond website. This allows us to know how much we have invested and keep track of our interest payments.

#7 Invest Your Supplementary Retirement Scheme (SRS) In SSBs

Since December 2018, we can invest in the Singapore Savings Bonds using our Supplementary Retirement Scheme (SRS). This is one great way to use the Singapore Savings Bonds, especially if we are risk-averse investors.

The reason is that we can gain dollar-for-dollar tax relief for every dollar we contribute (up to $15,300 per year) to our SRS. Furthermore, if we do not invest our SRS funds, we only receive a nominal interest rate of 0.05%. To earn a better interest return but keep liquidity and take a very low amount of risk, we can invest our SRS funds in SSBs.

Read Also: Singapore Savings Bonds (SSB) Vs CPF Top Up. The Benefits And Drawbacks Of Both Options

4 Cons To Consider When Investing In SSB

#1 Lower Interest Returns

If we invested in the September 2024 issuance, we stand to receive a return of 3.06% per annum in the first year. This is lower than the return that we can get on certain other types of investments in the shorter-term, such as the 6-month T-bills which is paying 3.13% p.a.

We may also prefer slightly riskier investments such as the Astrea private equity bond series, which launched its recent Class A-1 bonds for Astrea 8 on the Singapore Exchange in July 2024 paying 4.35% p.a. We can also choose to invest in even higher-risk equity investments, such as the S&P 500 ETF, where the historical returns over a 10-year period have been over 10%.

Of course, when investing in higher-risk products, we need to understand our timeline and that the risks involved are different as well.

#2 Higher Interest Rates Only Come At The Tail-End

Due to the interest rate step-up feature, we tend to only get higher interest rates only at the tail-end of the 10-year SSB tenor.

#3 Bond Issues Give Different Interest Rates Every Month

The current September 2024 SSB pays 3.10% on average. The January to Jul 2024 issuances paid out an average 10-year interest rate of between 2.81% and 3.33%. This means we may find ourselves investing at a slightly lower or higher interest rate depending on the actual month that we start our investment.

Those who invested in June 2024 are earning 3.33% p.a. over 10 years, and 3.26% p.a. in the first year. However, those who invest in the September 2024 SSB will only earn 3.1% p.a. over 10 years, and 3.06% p.a. in the first year.

As mentioned, though, we can always redeem our SSB investments if it makes financial sense (at a $2 fee) to invest in newer SSB issues if they are paying a better overall interest rate.

#4 $200,000 Cap On Our SSB Investments

There is a limit of $200,000 that we can invest in the Singapore Savings Bonds.

At the same time, it is also possible we might not get our full requested allotment depending on the demand during each particular tranche. This has been more relevant in previous tranches as interest rates hiked to nearly the 4%-mark.

#5 Allotment is Not Guaranteed

When we apply for SSBs, there’s no guarantee that we will get the full allotment that we applied for. For example, in the June and July 2024 SSB launch, MAS offered a maximum of $1 billion and $1.1 billion respectively. However, applications were more than the maximum amount, coming in at $1.61 billion and $1.26 billion. That means those who applied may not have gotten the full application amount – which may result in missing out one month of interest returns as well as potentially receiving a lower return in the following month.

How To Start Investing In The Singapore Savings Bonds?

Step 1: What We Need Before Applying

Before we even start investing in the Singapore Savings Bonds, we need to ensure that we have a bank account with one of the three local banks in Singapore – DBS/POSB, OCBC or UOB.

We also need to have a CDP account that is linked to our bank account through direct crediting service (DCS). This allows us to purchase the Singapore Savings Bonds, via ATMs, and will be stored in our CDP account. The CDP will also process the applications, interest payments and redemptions of our Singapore Savings Bonds investments.

Read Also: Step-By-Step Guide To Opening A Stock Brokerage Account In Singapore

Step 2: Apply Via ATMs or Internet Banking

Once we ensure we have everything in Step 1, we can proceed to apply for subsequent Singapore Savings Bonds issues via the ATMs or internet banking services of DBS/POSB, OCBC or UOB. When we do this, we need to have our CDP account number on hand.

Once we apply, the money will be directly deducted from our bank account.

We can only apply from 6 p.m. on the 1st business day of the month to 9 p.m. on the 4th last business day of the month for each Singapore Savings Bonds issue.

Once we apply, we will also see that a $2 non-refundable transaction fee will be applied on our application. This fee, which also applies to IPO applications, will apply to all Singapore Savings Bonds applications and withdrawals.

If we want to invest our SRS funds, we can do so via the internet banking portal of our SRS operator.

Step 3: Check For Your Singapore Savings Bonds Allotment

On the 3rd last business day of the month, MAS will allocate new Singapore Savings Bonds to those who successfully applied.

We may also receive a lower allotment of the Singapore Saving Bonds than what we have applied for if there is an oversubscription. For example, in the July 2024 SSB, a maximum of $1.1 billion worth of Singapore Savings Bonds was offered. However, the total amount applied was over $1.26 billion with the quantity ceiling fixed at $59,000. Hence, we may not get our full applied amount.

If we do not receive the amount of Singapore Savings Bonds that we applied for, the excess cash will be refunded to our bank account.

The Singapore Savings Bonds will be issued on the 1st business day of the month. We will be notified via mail of the amount of Singapore Savings Bonds allotted to us, or we can verify it online through the CDP Internet service, or by calling CDP at 65357511.

Step 4: Receive Interest Returns

After six months, we will receive our first interest payment on our Singapore Savings Bonds. This will be automatically paid into our bank account, linked to our CDP account. We will continue receiving interest payments every six months after that.

For the September 2024 SSB, the first interest payment date will be on 1 March 2025, and subsequent payments will be every six months on 1 September and 1 March each year.

We can consider investing in different issues to smoothen out the difference in interest returns on the particular Singapore Savings Bonds issue, as well as receive interest payments on a staggered basis so we can either reinvest the same way or use for our monthly expenses.

How To Redeem Singapore SSB Investments?

As mentioned several times, we can redeem our SSB investments by paying a $2 transaction fee. Each month, we can redeem our SSBs from the 1st business day, 6 p.m., until the 4th last business day, 9 p.m. We can only redeem in multiples of $500, and up to the amount we invested. Of course, if we are invested in several SSBs at the same time, we can redeem in multiple tranches.

Cash investments in SSBs can be redeemed via our internet banking on DBS/POCB, OCBC or UOB. We can redeem via mobile banking on OCBC as well. SRS investments in SSBs can be made online via our SRS operator.

We will receive our SSB investments, as well as any accrued interest (or pro-rated interest), by the 2nd business day of the following month. This means it can take up to one month for us to redeem our SSB investments. It also means we do not lose out on interest returns by redeeming our SSB investments earlier. We can calculate this accrued interest on the MAS website.

This article was first published on 15 October 2018 and has been updated with the latest information on the Singapore Savings Bonds (SSBs).

The post Complete Guide To Buying Singapore Savings Bonds (SSB) [2024 Edition] appeared first on DollarsAndSense.sg.