Many of us would have been advised to get on the property ladder as soon as possible so that we could stretch our loan longer and ride the long-term trend. As such, in Singapore, where we have one of the highest homeownership rates in the world, the proverbial question of whether to buy or rent a private property may seem as clear as day—or is it?

Proponents of property ownership would be quick to point out the rise in property prices over the past couple of years as the basis for their case. In fact, private property prices increased by 6.7% last year (2023), after rising by 19% over the previous two years. Furthermore, we are also seeing new condo launches in the Outside Core Region (OCR) region, like J’Den at Jurong East, hitting record highs at around $2,400 per square foot (psf). Thus, it may seem like not buying today may mean we may not have the same level of affordability in the future, making our private property ownership dream more elusive.

At the same time, the acceptance of renting has also shifted among locals, especially during the Covid-19 pandemic. More couples were willing to rent while they waited for their BTOs to be completed, as well as singles who simply wanted their own space, with work-from-home (WFH) emerging as a new work trend.

Property Prices Surged Due To Pandemic-Induced Demand

Private property prices in Singapore remained largely flat from 4Q2018 to 3Q2020. However, demand started surging at the onset of the Covid-19 pandemic, as depicted by the steep increase in the URA Property Price Index (PPI) below. Overall, private properties in the three different regions saw an increase of 10% (Core Central Region), 38.5% (Rest of Central Region), and 31.6% (Outside Central Region) from 3Q2020 to 3Q2023.

Source: URA – 3Q2023 Private Property Statistics

This surge in prices was fuelled by a few factors, such as a smaller supply of completed new private developments in 2020, higher demand from owner-occupiers for resale private properties amid the construction delays caused by the pandemic, higher demand from expats and higher labour costs and raw materials caused by the war between Russia and Ukraine.

To curb this strong demand and steep rise in property prices, the government has introduced three new cooling measures since December 2021, with the third and latest in April 2023. In the latest round, the Additional Buyer’s Stamp Duty (ABSD) was raised to 20% for Singaporeans and 30% for Singapore Permanent Residents buying their second property, while foreigners had to pay 60% ABSD when buying a residential property.

Additionally, the government also ramped up the supply of Built-To-Order (BTO) HDB flats by 100,000 from 2021 to 2025. It also increased the Confirmed List supply of private housing in the Government Land Sales (GLS) from 5,160 units in 2H2023 to 5,450 units in 1H2024. This is the highest supply on the Confirmed List since the 2H2013 GLS Programme.

Read Also: Does It Makes Sense For A Foreigner To Buy A Property In Singapore?

Rental Market May Be Moderating In The Coming Quarters

Over the same period, rent for private properties also recorded steep increases, as shown by the URA Rental Index of Private Residential Properties. Overall, rent in the regions of CCR, RCR, and OCR gained 48.5%, 59%, and 63.4%, respectively, from 3Q2020 to 3Q2023.

Source: URA – 3Q2023 Private Property Statistics

Many of the factors that led to the rise in demand for the rental of residential properties by both foreign and local renters have eased.

With the reopening of the Singapore-Malaysia borders, demand from non-resident Malaysian workers has dropped as more people return to commuting back and forth. Moreover, local workers who wanted their own space to adapt to the WFH culture may find themselves rethinking their needs as more workers return to working in offices.

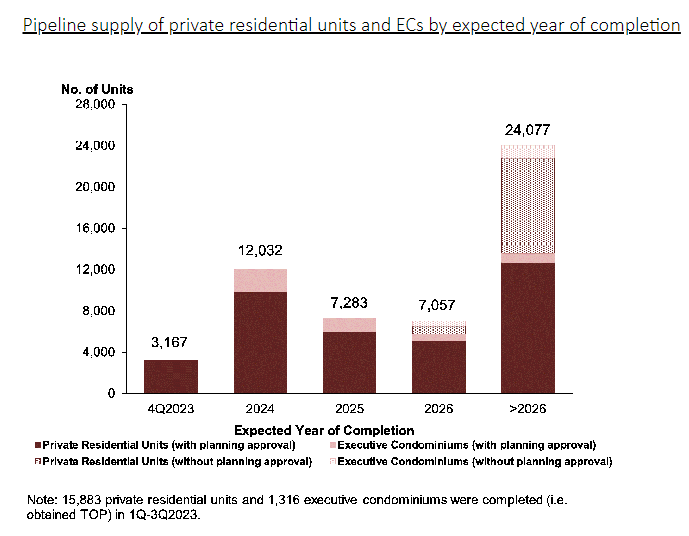

Additionally, a large group of locals who needed temporary occupation due to the construction delay of their new homes may find themselves moving to their abode soon, as over 20,000 units (including ECs) are expected to be completed in 2023. This is the highest annual private housing supply completion since 2017. Notably, some of the major projects completed this year include developments like Normanton Park (1,862 units), Treasure at Tampines (2,203 units), and Parc Clematis (1,468 units).

Source: URA – 3Q2023 Private Property Statistics

More than 26,000 units are expected to be completed in the next three years, with at least 12,000 units ready in 2024 alone. The completion of these homes is expected to increase the supply of homes available for rent and moderate the rental market.

Read Also: What Happens When You Buy A Property Above or Below Valuation?

What Are Your Options: Buying Vs Renting

Though property prices are at a peak, borrowing rules such as the Total Debt Servicing Ratio (TDSR) and ABSD have reduced the potential for “paper hands” among property owners. Short of a recession and mass retrenchments, most homebuyers today would be able to finance their properties and would be less likely to let them go at steep discounts from their purchase price. Hence, while property prices may see slower price growth, or even a small correction, we may not see steep price declines.

On the other hand, rents may moderate in the coming quarters given the higher supply of completed units in 2023 and over the next couple of years. This may lead to more landlords competing with a smaller pool of tenants and lowering their asking rents to secure a tenant. In such situations, it might be more beneficial to rent such properties than to buy them.

We take a look at the median property prices and rents for properties with an average size of 800 – 900 sqft (a typical 2-bedroom condo unit) across the different districts to find out where it might be more cost-effective to rent than buy.

Prices for the median property prices are extracted from Square Foot Research and are based on 4Q2023 Median Price for Non-landed, 99-Year. The median rents are extracted from Square Foot Research and are based on 3Q2023 Median Rents (Non-Landed).

District

Property Price

(800-900 sqft)

Rent

Rent Yield

1 – Temasek Boulevard, Raffles Link

$1,665,000

$5,800

4.18%

2 – Anson, Tanjong Pagar, Chinatown

$2,165,500

$4,600

2.55%

3 – Queenstown, Tiong Bahru

$1,600,000

$6,000

4.50%

4 – Telok Blangah, Harbourfront

$1,680,000

$5,100

3.64%

5 – Pasir Panjang, Clementi

$1,815,000

$4,325

2.86%

6 – High Street, Beach Road

–

$5,600

–

7 – Middle Road, Golden Mile

$1,360,000

$4,800

4.24%

8 – Little India

$1,700,000

$4,500

3.18%

9 – Orchard, Cairnhill, River Valley

$2,376,500

$5,300

2.68%

10 – Bukit Timah, Holland Road, Tanglin

$2,168,000

$4,600

2.55%

11 – Watten Estate, Novena, Thomson

–

$4,200

–

12 – Balestier, Toa Payoh, Serangoon

$1,352,000

$4,000

3.55%

13 – Macpherson, Braddell

$1,490,000

$4,300

3.46%

14 – Geylang, Eunos

$1,465,000

$3,950

3.23%

15 – Katong, Joo Chiat, Amber Road

$1,152,500

$4,000

4.16%

16 – Bedok, Upper East Coast

$1,285,00

$3,850

–

17 – Loyang, Changi

$1,040,000

$3,450

3.98%

18 – Tampines, Pasir Ris

$1,305,000

$4,000

3.68%

19 – Serangoon, Hougang, Punggol

$1,250,000

$4,000

3.84%

20 – Bishan, Ang Mo Kio

$1,435,000

$4,200

3.51%

21 – Upper Bukit Timah, Ulu Pandan

$1,702,500

$4,300

3.03%

22 – Jurong

$2,139,000

$4,600

2.58%

23 – Bukit Panjang, Choa Chu Kang

$1,240,000

$3,725

3.60%

24 – Lim Chu Kang, Tengah

–

–

–

25 – Kranji, Woodgrove

$967,500

$3,375

4.19%

26 – Upper Thomson, Springleaf

–

$3,000

–

27 – Yishun, Sembawang

$1,135,000

$3,650

3.86%

28 – Seletar

$1,109,444

$3,600

3.89%

Source: Square Foot

Based on the above table, district 2, which consists of Chinatown and Tanjong Pagar, and district 10, which consists of Tanglin, Holland, and Bukit Timah areas, have the lowest rental yield of 2.55%. A lower rental yield tells us that either the home prices are overvalued or homeowners are willing to accept a lower rent due to high competition for tenants. Therefore, we can make a case that it’s more cost-effective to rent than buy an 800-900-square-foot unit in these districts.

On the other hand, district 3, which consists of Alexandra Road, Queenstown, and Tiong Bahru, has the highest rental yield of 4.50%. Given the high rental yield, we can make a case that it is better to buy than rent a unit here, as tenants are willing to pay more in rent compared to the home prices.

Read Also: CCR, RCR, OCR: What Do These District Classifications Mean When Looking For Your Property Purchase

How To Decide: Choose The Option That Gives The Best Value For Your Buck

Some of the financial advantages of renting versus buying a property are that you can save on large cash outflows such as a downpayment, renovation costs, stamp duty and legal fees, which could amount to more than 30% of the purchase price.

Furthermore, you also need to deal with recurring costs like property tax – which will increase in 2024; utility and maintenance fees – which may also increase as GST rises to 9% from 1 January 2024, and other furniture and fitting replacement costs for unexpected breakdowns or wear and tear. However, as a renter, you have better visibility over your expenses, which are only your rent commitment, as most of these costs are included in the rent.

Assuming you have the funds to purchase a property, you could instead use the investment funds for higher-yielding investments. These include stocks and S-REITs, which have an average dividend yield of 8.2% (as of November 2023). These asset classes do not incur any profit-gain tax, unlike rental income from real estate. You could also consider maximising your CPF funds for higher returns, especially as the interest rates on Special Account (SA) will increase to 4.08% per annum (p.a.) from January–March 2024, with a floor rate of 4% p.a.

Therefore, if you’re intending to buy a property in 2024, it’s important to calculate the potential returns from renting it out versus the returns from other investment asset classes. If renting out a property gives a high return, you are better off buying the property. On the other hand, if you can get higher returns from other asset classes, you could instead choose to rent in districts where it’s more cost-effective to do so.

Read Also: Complete Guide To Property Tax For Homeowners In Singapore

Listen to our podcast, where we have in-depth discussions on finance topics that matter to you.