The Retirement Sum Topping-Up (RSTU) Scheme can help us grow our CPF Special Account (SA) or, for those above 55, our Retirement Account (RA). Such voluntary top-ups are beyond what we normally contribute from our salary.

Via the RSTU, those below 55 can contribute to their Special Account up to the Full Retirement Sum (FRS). The FRS is $205,800 in 2024. Those above 55 can contribute to their Retirement Account up to the Enhanced Retirement Sum (ERS). The ERS is 1.5x the FRS, and is $308,700 in 2024.

Topping up will help us boost our retirement nest egg, and potentially reach our Full Retirement Sum (FRS) or ERS more quickly. Not only that, we will also benefit from a dollar-for-dollar tax deduction of up to $16,000 when making RSTU cash-top ups. Since 2022, this is for up to $8,000 for top-ups to our own Special or Retirement Account, and up to another $8,000 for RSTU top-ups to our loved ones’ Special or Retirement Accounts.

Do note that the tax relief on RSTU cash top-ups is shared with MediSave Account top-ups.

Read Also: CPF MediSave Top-Ups Or Special Account Top-Ups. Which Makes More Financial Sense?

More Singaporeans Making Use Of The Retirement Sum Topping-Up (RSTU) Scheme

The CPF Board reported that RSTU top-ups have been on the up in recent years In 2022, CPF members made $4.6 billion in CPF top-ups for their retirement savings.

Not only are CPF members making more RSTU top-ups, but more are also making the top-ups – 308,000 members made top-ups in 2021. This was higher than the 220,000 members who topped-up in 2021, and 140,000 who topped-up in 2020. While it is clear that more people are taking the decision to make cash top-ups via the RSTU Scheme, there’s one other decision that’s in our hands – whether we make the top-ups at the start of the year or at the end of the year.

We look at a few pros and cons of making top-ups at the start of the year compared to at the end of the year.

Pro #1: Earn Higher Interest Rates When You Top-Up Earlier In The Year

When we make RSTU top-ups into our CPF at the start of the year, we will earn more in interest returns.

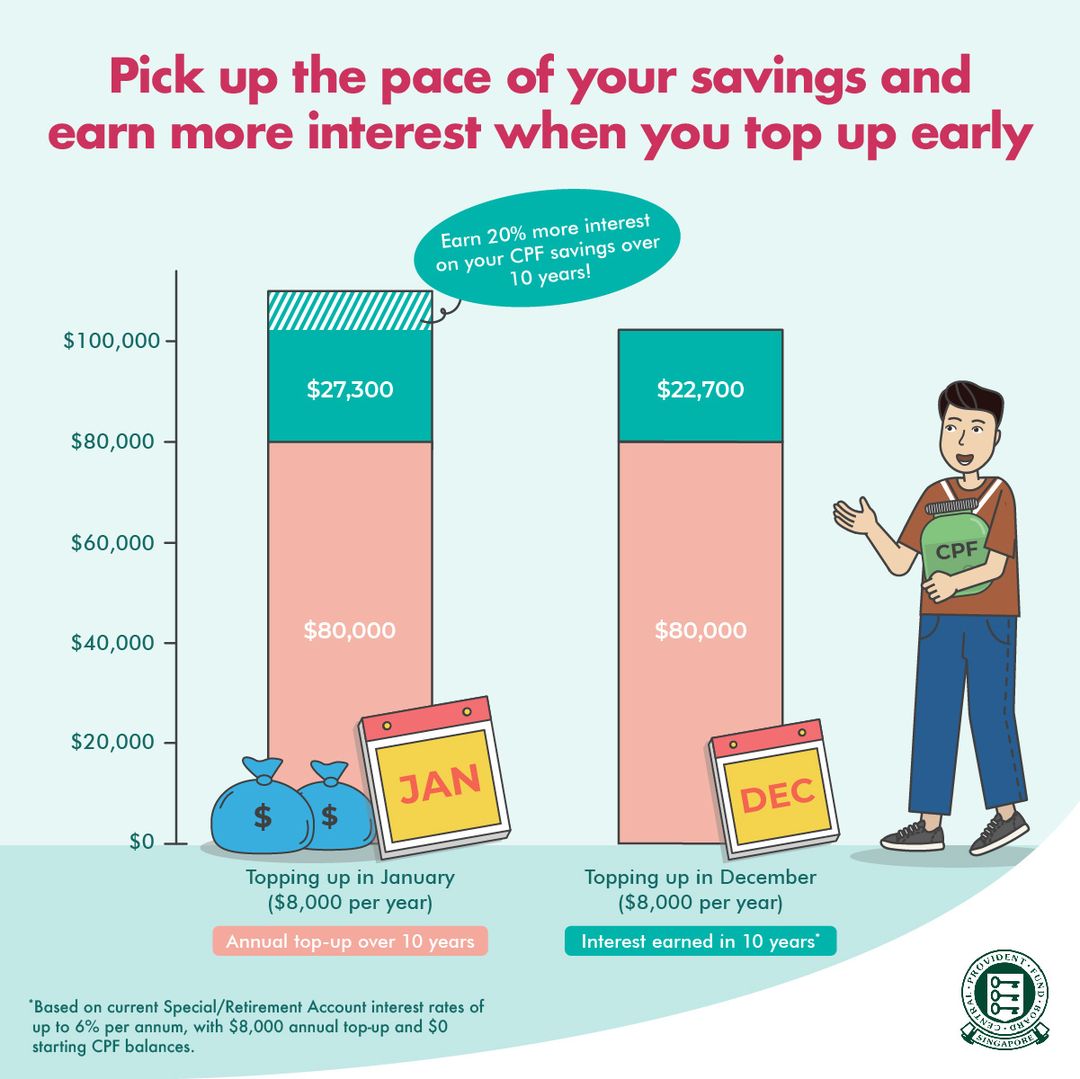

For example, if we make an $8,000 cash top-up to our Special or Retirement Account in January each year for 10 years, we will have $80,000 worth of top-up monies and $27,300 worth of interest returns.

However, if we topped up the same amount but made the Special or Retirement Account top-ups in December each year rather than January, we will have the $80,000 worth of top-up monies but only $22,700 worth of interest returns. This is more than 20% less in interest returns.

This happens because interest rates are calculated on a monthly basis, while only credited and compounded on a yearly basis. Note also that any CPF credits (including contributions) will only start earning interest returns in the following month. However, CPF withdrawals/ deductions stop earning interest returns in the month itself.

Source: CPF

Pro #2: Allocate Your Spare Funds In Advance

By making top-ups at the start of the year, we enjoy the intangible benefit of reducing our mental load. Similar to how some top leaders reduce mental fatigue by wearing the same outfit every day (think Steve Job’s iconic turtleneck and jeans), topping up at the start of the year can take a load off our minds.

We don’t have to worry about allocating cash each month or right at the end of the year to our Special or Retirement Account. Depending on the way we manage our money, we may not want to have the stress of a “recurring expense” even if we can stop it at any time.

Similarly, we may not need idle cash sitting around the entire year, possibly tempting us to draw on it before making the RSTU top-up at the end of the year.

Pro #3: If We Are About To Hit The Full Retirement Sum, We May Be Unable To Perform An RSTU During Year-End

For those of us who are below the age of 55, the maximum CPF top-up amount we can make to our Special Account via the RSTU is the Full Retirement Sum (FRS). However, our mandatory CPF contributions each month from work would continue to be contributed to all three CPF accounts including our Special Account. So this means we may still end up with a CPF Special Account balance that is beyond the FRS.

In 2024, the FRS is $205,800. Assuming we ended 2023 with a CPF Special Account balance of $200,000, we would be able make an RSTU top-up – albeit already less than the full $8,000 contributions we can enjoy tax relief on.

However, if we wait until the end of 2024, our monthly CPF contribution from work may likely push our Special Account balances beyond the FRS ($205,800 in 2024) for the year. In short, we may be in a position to make an RSTU top-up at the start of the year, but not by the time we hit the end of the year.

Guide To How You Can Contribute To Your Child’s CPF Accounts

Con #1: Less Cash Flow During The Year

CPF top-ups are irreversible. When we make an RSTU top-up at the start of the year, we immediately lose that cash flow in case of an emergency.

For example, the last few years may have been unpredictable for many people. But perhaps we may not know just how bad our year may be in January. If we made our RSTU top-ups of up to $16,000 in January and later find ourselves retrenched, facing a pay cut or put on no-pay leave, we may be left in a tight financial situation. And the $16,000 could have come in handy.

By contributing on a monthly basis, we break down the figure into more bite-sized amounts or only allocate excess cash into our CPF respectively. By doing it only at the end of the year, we would already have saved that spare cash.

Con #2: May Not Receive Full Benefits Of Tax Deduction

Each year, individuals have a personal income tax relief cap of $80,000. Once we reach this cap, any further actions we take to reduce our income tax will not apply.

If we had made our RSTU contributions at the start of the year, we would not know exactly what our income tax relief for the year would be. Obviously, we can guess this number, but we cannot know for sure.

If we do breach the $80,000 personal income tax relief cap, we would have benefitted from waiting to contribute only in the later part of the year.

Read Also: 6 Ways You Can (Legally) Reduce Your Income Tax In Singapore

Con #3: Inability To Change Our Minds When We Spot Better Opportunities

We’ve established that CPF top-ups are irreversible in the first point. In this con, rather than facing a cash flow crunch, contributing early in the year can also mean we lose out on opportunities. This is especially relevant if a unique opportunity comes up during the year that would beat the interest returns and tax benefits of making RSTU contributions.

For example, if we made RSTU contributions to our own and our loved ones’ CPF accounts in January 2020, we would not have been able to take advantage of the stock market crash in March 2020. We don’t know how the markets will move in 2024 – and they may perhaps offer opportunities should a correction happen.

RSTU Helps Us Grow Our Retirement Adequacy

Making RSTU top-ups builds up our retirement funds, and eventually gives us a bigger monthly payout via CPF LIFE. By taking money away from ourselves during our younger years, and locking it up in the CFP system, we are giving our older-self greater peace of mind during retirement.

This should be the main consideration when deciding to make RSTU top-ups. Once we have decided to make RSTU top-ups, then we can review the pros and cons of when we should transfer our money into the CPF system.

This article was first published on 24 January 2021 and updated with the latest information

Listen to our podcast, where we have in-depth discussions on finance topics that matter to you.