When we think of telecoms or wireless providers, we normally view them as stable businesses that provide reliable dividends.

That’s certainly the case, and a whole lot more, with the world’s largest mobile network operator in the world – China Mobile Limited (HKEX: 941). As the number one provider of mobile telecom services in China, China Mobile had 990 million mobile subscribers as of October 2023.

So, how did this business rise to the dominant player in the industry? Let’s dial in and find out.

China Mobile – A Chinese Trailblazer In The Hong Kong Stock Market

China Mobile, initially established as China Telecom (Hong Kong) Limited in mid-1997 in Hong Kong, marked a significant milestone in the privatisation of China’s state-owned telecom sector. It was among the first major Mainland Chinese companies to list its shares on the Hong Kong Stock Exchange, raising US$4.2 billion in the process. Additionally, the company expanded its reach by listing on the New York Stock Exchange.

Its initial public offering (IPO) in 1997 was notable, ranking as the third-largest globally that year in terms of funds raised. The company’s rapid growth and influence were further acknowledged when it was added to the Hang Seng Index in January 1998, a prestigious position it has maintained since then.

As of now, China Mobile holds a significant 3.6% weighting in the Hang Seng Index, a notable achievement for a telecommunications company. From its split-adjusted IPO price of HK$2.95, the company’s shares have surged to approximately HK$63, delivering investors more than a twenty-fold return on the stock price over the past 26 years.

How China Mobile Grew Into The World’s Biggest Telco

China Mobile has achieved the remarkable feat of nearly one billion mobile subscribers, thanks to its consistent growth over the past two decades. This success is partly due to effectively leveraging the development and deployment of 4G and 5G technologies. In the first half of 2013, the company generated RMB 274 billion (US$38.4 billion) in revenue and an EBITDA of RMB 123.7 billion.

Fast forward to the first half of 2023, and these figures have grown to RMB 530.7 billion in revenue and RMB 183.5 billion in EBITDA.

This represents a 10-year compound annual growth rate (CAGR) of 6.8% in revenue and 4% in EBITDA, which is pretty impressive in the global telecom industry.

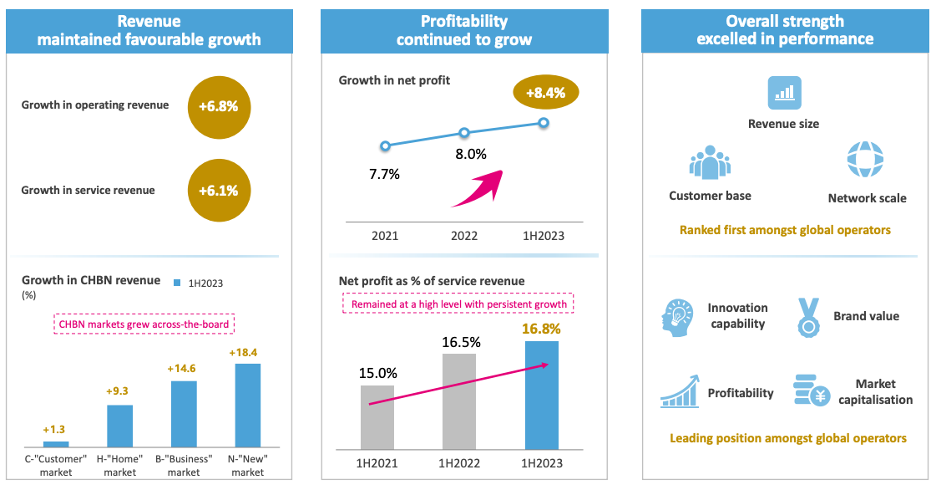

In the first six months of 2023, the company’s EBITDA grew by 5.5% year-on-year, outpacing the average. Moreover, the net profit increased by 8.4% year-on-year during the same period, continuing an upward trend in recent years. These numbers underscore China Mobile’s solid performance and growth in a competitive market.

Source: China Mobile H1 2023 earnings presentation

Growth Areas For China Mobile

One particularly promising area for investors in the company’s revenue model is its “New” market segment, which falls under the broader CHBN framework. This segment encompasses the company’s expanding international business. Notably, it has seen significant growth by exporting its advanced 5G solutions and high-quality capabilities to global markets and by enhancing the digital infrastructure of its overseas partners.

Additionally, the emerging fields of Artificial Intelligence (AI) and the Internet of Things (IoT) are increasingly contributing to the company’s growth. The company is also making strides in digital content platforms. Key offerings include MIGU video and cloud gaming, which are part of the China Mobile Metaverse Industry Alliance’s initiatives.

In terms of financial performance, the first half of 2023 was strong for China Mobile’s digital content segment. It reported revenue of RMB 13 billion, representing a year-on-year growth of 12.5%. This growth indicates the segment’s rising contribution to the company’s overall revenue and highlights its potential as a key growth driver.

Dividend Stalwart That Offers Stability

While China Mobile has exciting growth opportunities in future, it’s also generally seen as a reliable dividend payer given its strong cash flows.

As an example of that, in H1 2023 China Mobile hiked its interim dividend per share (DPS) by 10.5% year-on-year to HK$2.43. Based on its 12-month forward dividend of HK$4.86, China Mobile shares currently offer dividend investors a juicy yield of 7.8%.

China Mobile has consistently been a key player among companies listed on the Hong Kong Stock Exchange, thanks to its pioneering approach and early listing. Being predominantly state-owned, the company has attracted many investors who value the stability of its business operations and the regularity of its dividend payments.

This reliability is evident in its 2023 share price performance; China Mobile’s Hong Kong-listed stock has risen over 18% year-to-date, in stark contrast to the 19% decline of the Hang Seng Index during the same timeframe. For investors seeking stable exposure to the Chinese market with the added benefit of receiving dividends, China Mobile is a stock to monitor.

Read Also: The History Of Lenovo, The World’s Largest PC Maker

Advertiser Message

Looking to gain exposure to the Hong Kong Stocks here on SGX?

You can do so via Daily Leverage Certificates (DLCs) that allows you to gain leveraged exposure of up 7x on

key Hang Seng Indices and 5x on Hong Kong Stocks for both Long and Short direction. DLCs are listed on SGX

Securities Market and can be traded through a regular stock brokerage account. Learn more about the product

features and associated risks on the Societe Generale DLC website.

Check out the latest

Broker Promotion

– Trade the DLCs and get S$200* cash credit (T&Cs apply)

Check out the latest

Broker Promotion

– Be rewarded when you trade SGX Listed DLCs. Claim your S$150 Now! (T&Cs apply)

This advertisement has not been reviewed by the Monetary Authority of Singapore. The DLCs are for specified investment products (SIP) qualified investors only.